Elle, a 7-year old girl, made her hands dirty in stock picking. This time she decided to buy GoPro stock. I was about to make use of my veto right but finally found her decision not bad at all.

Continue reading "JuniorDepot4 – Becoming Pro with GoPro"

Continue reading "JuniorDepot4 – Becoming Pro with GoPro"

Category: English

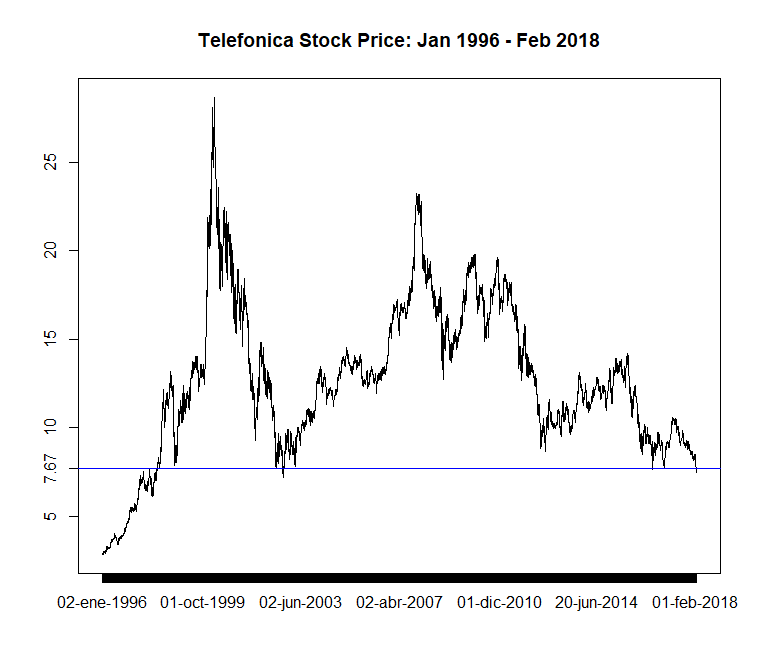

Telefonica (ES0178430E18) – A Trading Chance From Spain

Telefonica a Spanish telecommunication company, one of the largest in the world. It is also very active in Germany (with o2 brand). Telefonica's stock is a component of the Euro Stoxx 50 and currently looks promising both from technical and fundamental points of view. Telefonica always was a good dividend payer, however, there is a pitfall with the Spanish tax at source (Quellensteuer).  Continue reading "Telefonica (ES0178430E18) – A Trading Chance From Spain"

Continue reading "Telefonica (ES0178430E18) – A Trading Chance From Spain"

QuantLibXL – A Curvy Way to fit a Yield Curve

QuantLib is a magnificent library for quantitative finance. But it is also like a gun, heavy enough to shoot your own foot. You might expect that QuantLibXL (a plug-in that provides a subset of QuantLib functionality in Excel) makes your life easier. Unfortunately, it hardly does, as we show in this case study. For an easy and straight way you should better have a look at Deriscope. Continue reading "QuantLibXL – A Curvy Way to fit a Yield Curve"

QuantLib is a magnificent library for quantitative finance. But it is also like a gun, heavy enough to shoot your own foot. You might expect that QuantLibXL (a plug-in that provides a subset of QuantLib functionality in Excel) makes your life easier. Unfortunately, it hardly does, as we show in this case study. For an easy and straight way you should better have a look at Deriscope. Continue reading "QuantLibXL – A Curvy Way to fit a Yield Curve"

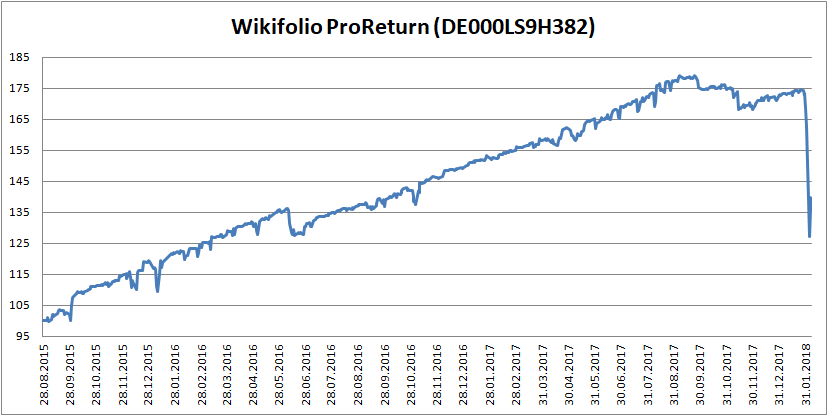

Wikifolio ProReturn is 45% down – Greedy German pays the Price (over and over) again

ProReturn, one of the most popular wikifolios, lost about 45% of its value during recent market flash crash. Several millions Euro disappeared within two days. But it seems that greedy German retail investors will never learn. Moreover, they don't want and are hardly able to learn, although the German school education system is free of charge an still much better than that in US and UK. Well, jedem das Seine!

Continue reading "Wikifolio ProReturn is 45% down – Greedy German pays the Price (over and over) again"

Continue reading "Wikifolio ProReturn is 45% down – Greedy German pays the Price (over and over) again"

JuniorDepot3a – explaining correlation and diversification to a 7 year old girl

Market fall and so does Elle's portfolio. However, we still perform better than market due to diversification. So we use the opportunity to explain a 7-year old girl the idea of correlation. Continue reading "JuniorDepot3a – explaining correlation and diversification to a 7 year old girl"

JuniorDepot 3 – Buying DAX Dividend-Cows

Elle, a 7 years old girl learning to manage her wealth on her own, made her second investment. We used recent market correction to buy an ETF on DivDAX, which consists of the 15 DAX stocks with the highest dividend yield (and mostly low p/e). Continue reading "JuniorDepot 3 – Buying DAX Dividend-Cows"

Beyond Black Scholes: European Options without Dividends

Options are the simplest non-trivial financial derivatives around. They are part of the curriculum of every university course on Finance for a good reason: They are everywhere! They are traded on regulated exchanges around the world, change hands over the counter between … consenting adults, enhance or "infect" all sorts of contracts as "embedded options", constitute the main ingredient of insurance policies. In their pure form, their annual volume on U.S. Equity Option exchanges alone exceeds 4 billion contracts!

Options are the simplest non-trivial financial derivatives around. They are part of the curriculum of every university course on Finance for a good reason: They are everywhere! They are traded on regulated exchanges around the world, change hands over the counter between … consenting adults, enhance or "infect" all sorts of contracts as "embedded options", constitute the main ingredient of insurance policies. In their pure form, their annual volume on U.S. Equity Option exchanges alone exceeds 4 billion contracts!

This is the first of a series of articles that will show you how to compute the fair value of options within Excel without using expensive third party software. Continue reading "Beyond Black Scholes: European Options without Dividends"

Market Data Quality – Beware the Splits and Dividends

Recently we made an ex-post analysis of our ETF screening efficiency and detected the price data inconsistency for 4 of 21 ETFs in question. Having a closer look at these ETFs, we explain the causes of inconsistency and emphasize that your trading strategy is only as good as your data (quality controls) are! Continue reading "Market Data Quality – Beware the Splits and Dividends"

Screening DeGiro free ETFs – 5 months later

On 3rd September 2017 we published a gallery of 21 ETFs and ETCs, which can/could* be traded (one a month) free of charge by our broker DeGiro. We always encourage you not to forget the past, so we publish current charts of these ETFs and you can see how things went on. Continue reading "Screening DeGiro free ETFs – 5 months later"

JuniorDepot 2 – Elle makes her first Investment in Silver

As we have recently reported, one of our readers has set up a savings plan (€100/mo.) for his 7 years old daughter Elle. We loved the idea and suggested him to let the girl decide herself,

which stocks and ETFs to buy; letYourMoneyGrow.com team assists in risk management and portfolio optimization. Our ambitious goal is to grow a new (female) Warren Buffett. Meanwhile, Elle made her first investment decision! Continue reading "JuniorDepot 2 – Elle makes her first Investment in Silver"