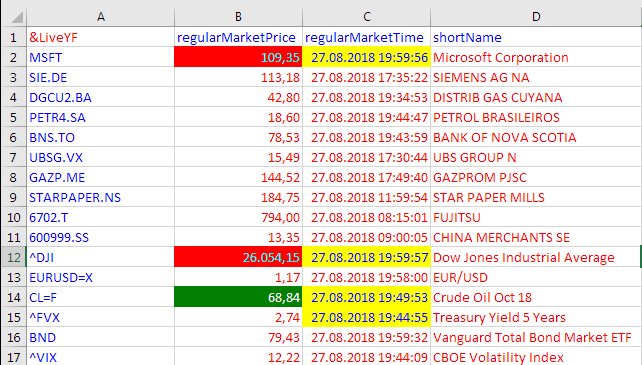

On the fateful Wednesday of November 1st, 2017 Yahoo decided to stop their – until then – free service of delivering real time market data as a text stream through a special URL. For hundreds of businesses and individuals who had relied for years on Yahoo's benevolent free service, this single action meant only one thing: Instant death! Continue reading "Yahoo Finance Live Feeds in Excel after their API Discontinuation in November 2017"

Category: English

JuniorDepot9 – Buying Silver ETC again

Elle, a 7-year old girl, confronted a hard choice this time: both German stocks and precious metals were relatively cheap. Finally, she decided to increase the position in silver, although before she has already bought a silver ETC a little bit prematurely. Continue reading "JuniorDepot9 – Buying Silver ETC again"

Your Fundamental Analysis is Only as Good as Your Data are: The Example of NWL

Whereas the opinions on the usefulness of technical analysis are highly controversial, it is generally agreed that the fundamental analysis does make sense. Value investing, e.g. the choice of companies with low p/e and p/b coefficients but high RoE and EBIT-Margin is not an uncommon approach. However, the data quality and creative data interpretation are critical. Otherwise one yields yet another GiGo: Garbage in, Garbage out! Continue reading "Your Fundamental Analysis is Only as Good as Your Data are: The Example of NWL"

What You Have Missed by Not Buying Our Stocklist for just $5 – Part II: Statistical significance

Two months ago we suggested you to buy a list of stocks, carefully selected from SP500 index on both fundamental and technical criteria. One month later we have published the results: though our stocklist has clearly beaten SPY there were no evidences of formal statistical significance. Now there are. Moreover, you have an opportunity to buy our next stockpicking report just for $10. Continue reading "What You Have Missed by Not Buying Our Stocklist for just $5 – Part II: Statistical significance"

A Fairy Tail or The Magic of Extreme Casino Wins

Michael Shackleford, a who has made a career of analyzing casino games, designed Australian Reels Slot Machine in 2009. In modeling the casino's risk of ruin he (blindly) relied on the normal distribution. We show that this drastically undervalues the tail risk. Continue reading "A Fairy Tail or The Magic of Extreme Casino Wins"

JuniorDepot8 – Buying Silver ETC and DAX ETF

Elle, a 7-year old girl, continues to grow her wealth. Recently she has bought a silver ETC and a DAX ETF (the former a little bit prematurely, the latter pretty optimally). Continue reading "JuniorDepot8 – Buying Silver ETC and DAX ETF"

PropellerAds delivers Bullshit and Malware – avoid it!

By letYourMoneyGrow.com we also want to grow our own money, thus we tried to put Propeller Ads on our pages. But we pursue a win-win collaboration with our readers and never grow our money at their costs. Had Propeller Ads "merely" delivered a bullshit, we would just silently abandon it. But it also supplies malware, thus we feel obliged to apologize to our readers. Fortunately, there is virtually no danger since we promptly removed all PropellerAds content from our website.

Continue reading "PropellerAds delivers Bullshit and Malware – avoid it!"

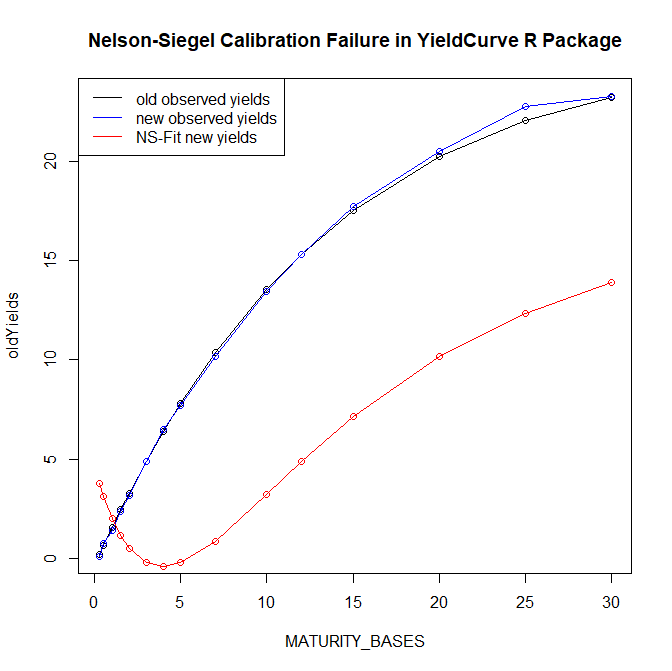

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do

In our previous post on Nelson-Siegel model we have shown some pitfalls of it. In this follow-up we will discuss how to circumvent them and how machine learning and artificial intelligence can[not] help. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do"

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I

The Nelson-Siegel-[Svensson] Model is a common approach to fit a yield curve. Its popularity might be explained with economic interpretability of its parameters but most likely it is because the European Central Bank uses it. However, what may do for ECB will not necessarily work in all cases: the model parameters are sometimes extremely unstable and fail to converge. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

JuniorDepot7c – Lots of Actions and Calculations

Market were really turbulent during the last weeks. We committed a lot of trades with Elle and did some important calculations of our trading costs. Continue reading "JuniorDepot7c – Lots of Actions and Calculations"