Quantopian is a very interesting FinTech project for virtually everybody, who wants to try the algorithmic trading. Yet I explain why I myself - a successful trader, experienced quant and good programmer - don't take part. Continue reading "Quantopian – why I don’t take part"

Category: FinTech

7 good Wikifolios – Automatic Statistical Performance and Risk Analysis

Wikifolio is a FinTech start-up that lets virtually everybody to become an fund manager. Wikifolio adheres to highest public disclosure standards, in particular current portfolios and complete trading statistics are available in real time. However, wikifolio lacks any statistical and chart analysis. One cannot even add a benchmark like DAX or DJ30 to a wikifolio chart.

We propose a way to increase the value of disclosed information and looking forward for feedback from both Wikifolio trades and investors. We also hope for official feedback from Wikifolio team.

Continue reading "7 good Wikifolios – Automatic Statistical Performance and Risk Analysis"

Anti-Asimov’s Three Laws of Robo-Advisory

- Falsely affirm that nobody can beat the market

- Substitute the idea of wealth maximization with the idea of cutting-off the management fees.

- Don't disclose anything about the underling portfolio optimization model and avoid showing possible future portfolio dynamics.

Continue reading "Anti-Asimov’s Three Laws of Robo-Advisory"

Big Data and Deep Learning, a technology revolution in trading or yet another hype?

Summary:

- BigData and DeepLearning are popular buzz words nowadays. But the number of the genuine success stories is relatively small.

- In trading the BigData technology is mostly associated with automatic analysis of the news and sentiment in social networks. But unless you are Google or Reuters, you will never be the one who gets the news first. Additionally, a market reaction both to news and sentiment is often vague and amorph.

- Large deep neural networks closely resemble a human brain, which also has a lot of neurons, interconnected in many layers. But it doesn't mean a breakthrough to a real artificial intelligence: all is not gold that glitters.

- a positive side: trading is only a part of the financial world. Likely, BigData + DeepLearing has a high potential in adjacent areas like risk profiling and credibility analysis.

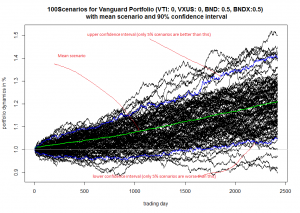

A simple scenario simulator for Vanguard optimal portfolio

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

Continue reading "A simple scenario simulator for Vanguard optimal portfolio"

Einstein – a star trader on Wikifolio, who can beat the market

Summary: In our previous post we reviewed Wikifolio.com, a FinTech project that lets everybody build a proven track record. Today we review the performance of Einstein's portfolio "Platintrader 1000% Leidenschaft" and explain why his performance is a matter of trading mastership, not of just luck.

Continue reading "Einstein – a star trader on Wikifolio, who can beat the market"

Wikifolio – a genuinely social trading and investment FinTech project

Update 30.07.2017: Unfortunately, Wikifolio turned out to be not a genuinely social FinTech but rather yet another attempt to make quick money at costs of retail investors. Here we explain why (in German). But we keep the original post below for historical purposes.

Summary of advantages:

- Wikifolio allows everyone to build a proven track record. If a portfolio meets some simple requirements, an ETF on it can be issued. Technically such ETFs are issued like certificates by Lang & Schwarz and are traded by L&S directly and on the Stuttgart Exchange.

- Wikifolio adheres to maximum disclosure policy: in particular, for every portfolio they provide complete trading history in real time.

- Wikifolio is very suitable for the strategies that imply frequent trading since there is no costs per trade (only bid-ask spread and all-in fee of 0.95% p.a.)

- Wikifolio liberates portfolio management from regulatory cram and lets investors meet the portfolio managers directly (without expensive and dubious middlemen). At the same time the investors do not need to transfer their money directly to portfolio managers, so there is virtually no scam risk.

- Last but not least, numerous successful traders on Wikifolio clearly disprove the mantra that "nobody can beat the market".

Continue reading "Wikifolio – a genuinely social trading and investment FinTech project"

Stripping down the robo-advisors: sparrow-brains inside

Summary:

- Robo-advisors promise the risk profiling in a few easy steps, which is unrealistic both from mathematical and behavioral points of view.

- The "optimal" portfolios are usually based on Markowitz-like models, which are inapplicable in practice due to their extreme numerical sensitivity to the market parameters estimation errors.

- Robo-advisors lure investors with low management fees but minimizing fees and maximizing the wealth is not the same. Moreover, the compound costs are not so small in the long term.

- A positive side: Robo-advisers do not (yet) foist toxic financial products upon you.

Continue reading "Stripping down the robo-advisors: sparrow-brains inside"