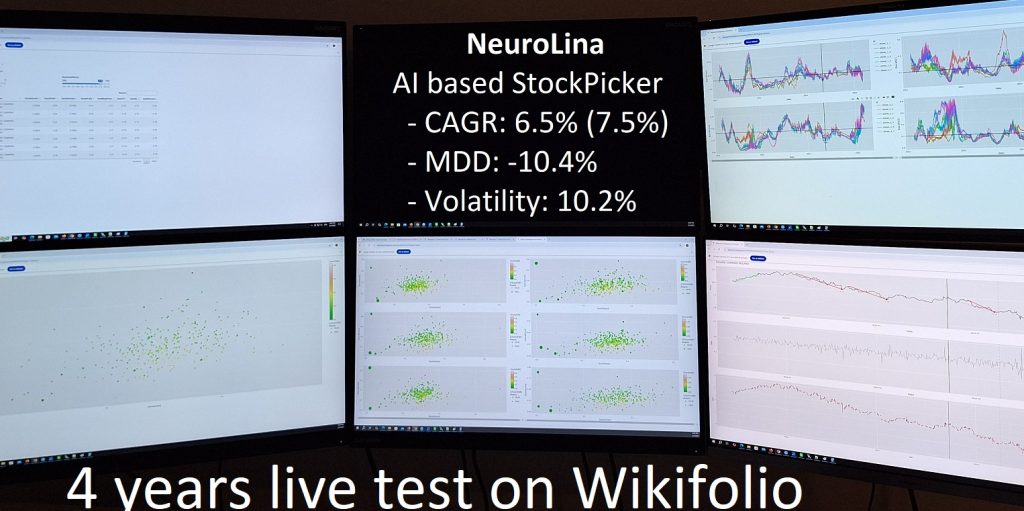

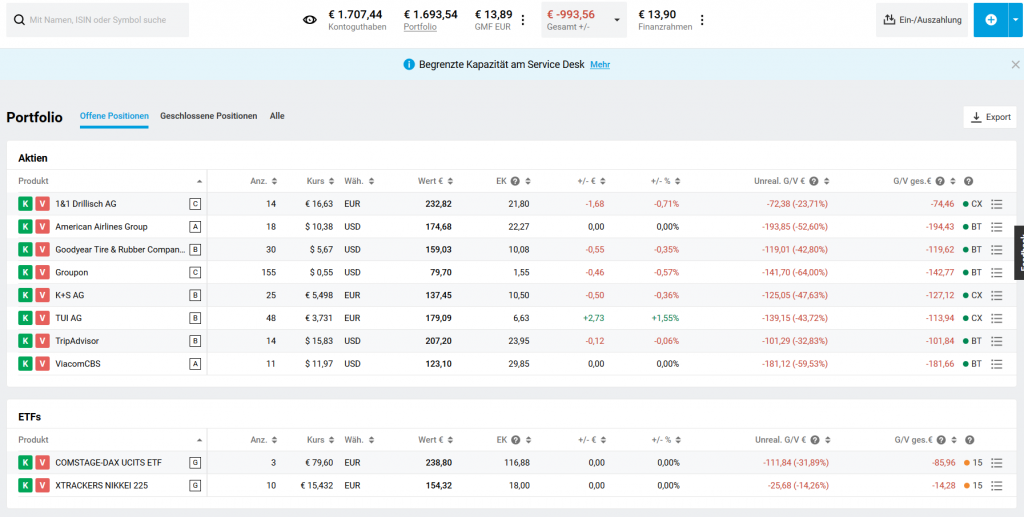

After 4 years of a live test of my AI-based stock picker Neurolina on a 3rd party service I publish (and close) NeuroLina Wikifolio and summarize the performance.

Continue reading "AI Stockpicker NeuroLina – 4 Years of Live Test on Wikifolio"

Category: GermanStocks

Bye-bye Software AG and BBBY

Today - on 24.04.2023 - Software AG stock jumped +50% due to a takeover offer from private equity firm Silver Lake, whereas Bed Bath & Beyond filed for bankruptcy. Continue reading "Bye-bye Software AG and BBBY"

Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality

A pig will find the dirt (Russian proverb). The market will find reasons to grow. To fall as well. It is worth documenting (and periodically recalling) what happened on 9/11/2000 (as well as shortly before and after this date).

In the end of October the German market was not in the mood, upset by the 2nd (partial) lockdown. However, after a healthy DAX correction, the greed got started to dominate again. On November the 9th two really(?) good news arrived: first the preliminary victory of Joe Biden, followed by 90% efficiency of Pfizer/BioNtech vaccine.

Continue reading "Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality"

Continue reading "Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality"

The Epic Rise and Fall of Wirecard AG – The Money Management View

Wirecard is a German company, which provides e-payment solutions. It grew very rapidly but the fall was even quicker. This case perfectly demonstrates the advantages of diversification and money management. Continue reading "The Epic Rise and Fall of Wirecard AG – The Money Management View"

JuniorDepot25 – Profitable Again

Elle's depot turned back to profitability thanks to recent exuberant market growth. We closed most of our positions and await a drop after a pretty groundless euphoria. Continue reading "JuniorDepot25 – Profitable Again"

JuniorDepot24 – A Gradual Recovery

Elle's timing during the Corona-Crisis was premature and lead to a significant drawdown. However, her depot recovers gradually. We accumulate cash, awaiting the 2nd wave of COVID-19. Continue reading "JuniorDepot24 – A Gradual Recovery"

JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism

Unfortunately we (i.e. I) have misestimated the Corona-Virus impact. Elle's portfolio experiences a severe drawdown. Still we are happy that it happened in the beginning (rather than in the end) of our savings plan.

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

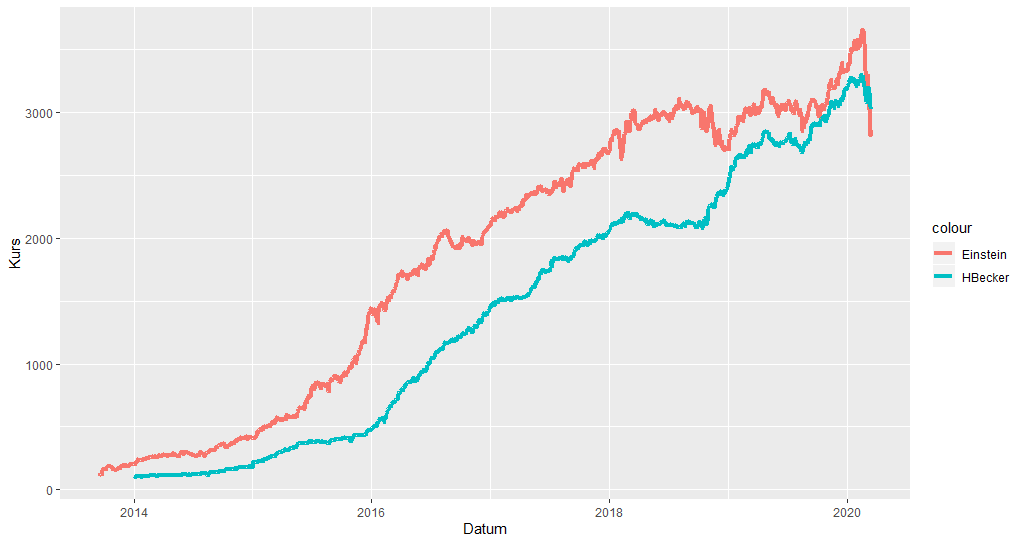

HBecker schlägt Einstein – Risikomanagement zahlt sich aus!

Vor einigen Jahren habe ich die Performance von den besten Wikifolio Tradern Einstein und HBecker analysiert. Mein Verdikt war beide sind besser... und obwohl HBecker (damals) N2 war, wäre er für viele Investoren doch attraktiver im Sinne der risikoadjustierten Performance.

Continue reading "HBecker schlägt Einstein – Risikomanagement zahlt sich aus!"

Continue reading "HBecker schlägt Einstein – Risikomanagement zahlt sich aus!"

4. Münchener Tischgespräch von DSW – drei interessante Präsentationen

Auf 4. Münchener Tischgespräch, organisiert am 05.12.2019 vom Deutschen Schutzverein für Wertpapierbesitz e.V. (DSW), hatte ich die Gelegenheit, drei interessante Vorträge von Fraport (ETR:FRA), Biofrontera(NASD:BFRA) und Deutscher Post(ETR:DPW) zu hören. Obwohl ich der quantitative Investor bin, also schaue ich eher auf die Zahlen als auf die Stories, fand ich die Information sehr interessant. Darüber hinaus war es keine Massenveranstaltung, sondern wirklich ein Tischgespräch im engeren Kreis.

Continue reading "4. Münchener Tischgespräch von DSW – drei interessante Präsentationen"

Continue reading "4. Münchener Tischgespräch von DSW – drei interessante Präsentationen"

JuniorDepot15 – Reaching 13.75% CAGR with stockpicking

Elle got started with her savings plan in Jan 2018 with a monthly installment of €100. Now she has sufficient trading capital, so that (taking broker fees into account) the stock picking may make sense. She tried to make her hands dirty with stock selection and earned €139,53 gain or 8.6% return in less than a month! The CAGR of her savings plan is currently 13.75% Continue reading "JuniorDepot15 – Reaching 13.75% CAGR with stockpicking"