Whereas Tom Tailor continues to decline, Gerry Weber has recently bounced +40% as the founder Gerhard Weber resigned from CEO position. Yet we bought Tom Tailor stock, although we usually do not trade against a strong trend. We explain why it was plausible to make an exception this time. Continue reading "Tom and Gerry 3: a dead mouse bounce?"

Category: GermanStocks

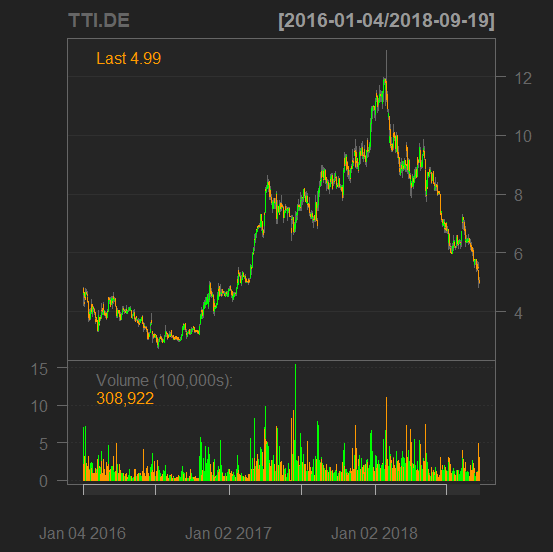

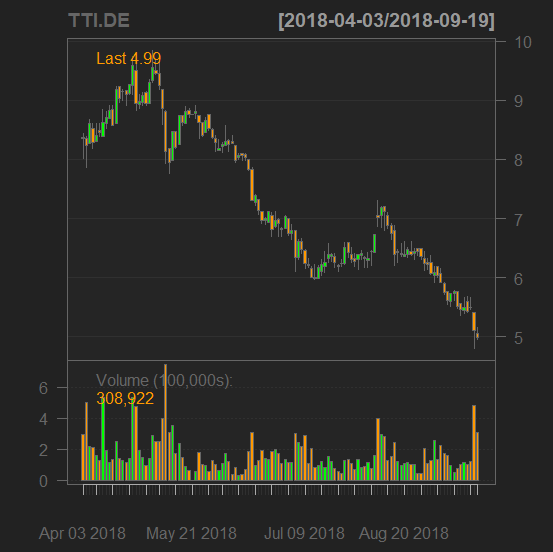

Tom and Gerry 2 – a perfect case study for peer trading

Tom [Tailor] and Gerry [Weber] are two German fashion boutiques (both are small caps). On January 7, 2016 I wrote a post "Tom And Gerry - Turnaround By Two German Fashion SmallCaps". In this post I correctly predicted the growth of Gerry Weber, based on the previous growth of Tom Tailor. Now one could have predicted the fall of Tom Tailor based on the previous fall of Gerry Weber. A perfect pair for peer trading isn' it?!

|

|

Continue reading "Tom and Gerry 2 – a perfect case study for peer trading"

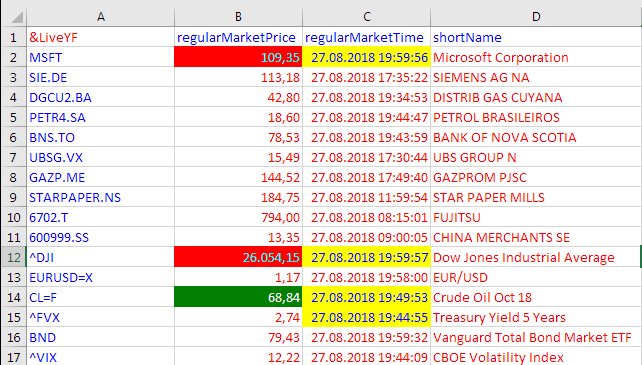

Yahoo Finance Live Feeds in Excel after their API Discontinuation in November 2017

On the fateful Wednesday of November 1st, 2017 Yahoo decided to stop their – until then – free service of delivering real time market data as a text stream through a special URL. For hundreds of businesses and individuals who had relied for years on Yahoo's benevolent free service, this single action meant only one thing: Instant death! Continue reading "Yahoo Finance Live Feeds in Excel after their API Discontinuation in November 2017"

JuniorDepot7a – Selling Silver and Buying DAX ETF

According to our plan, we sold a silver ETC near the upper line of a clearly visible channel. Today we used the DAX correction to re-buy an ETF on it. Continue reading "JuniorDepot7a – Selling Silver and Buying DAX ETF"

Zinseszinswunder in Action: mit 200 DM/mo. in DAX seit 1959 wärst Du Millionär

Wer in DAX seit 1959 jeden Monat 200 DM bzw. €100 angelegt hätte, wäre nun Millionär. Zwar es in diesem Fall auch viel "wenn das Wörtchen wenn nicht wär" gibt, ist dieser Fall nicht unrealistisch und bestimmt betrachtenswert. Denn selbst wenn man den Zeitvorrat nicht von 60 sondern "lediglich" von 30 Jahren hat und die Rendite "nur" von 6% p.a. erreicht, wird man zumindest die Altersarmut vermeiden! Continue reading "Zinseszinswunder in Action: mit 200 DM/mo. in DAX seit 1959 wärst Du Millionär"

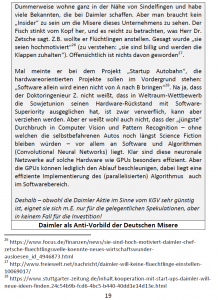

Prophetische Misere von Schmercedes: Daimler Aktie fällt

Heute fiel die Aktie von Daimler um mehr als 6%. Grund dafür war wohl der Dividendenabschlag aber vor allem die Enttäuschung der Aktionäre mit der Rede vom Dr. Z.

Dummerweise habe ich die Daimler als Beispiel genommen, als ich in meinem vor kurzem veröffentlichen Buch die Leser vor blinden Investitionen in "günstigen" Unternehmen warnte. Das war prophetisch und es lohnt sich diesen Fall genauer zu betrachten.

Continue reading "Prophetische Misere von Schmercedes: Daimler Aktie fällt"

Continue reading "Prophetische Misere von Schmercedes: Daimler Aktie fällt"

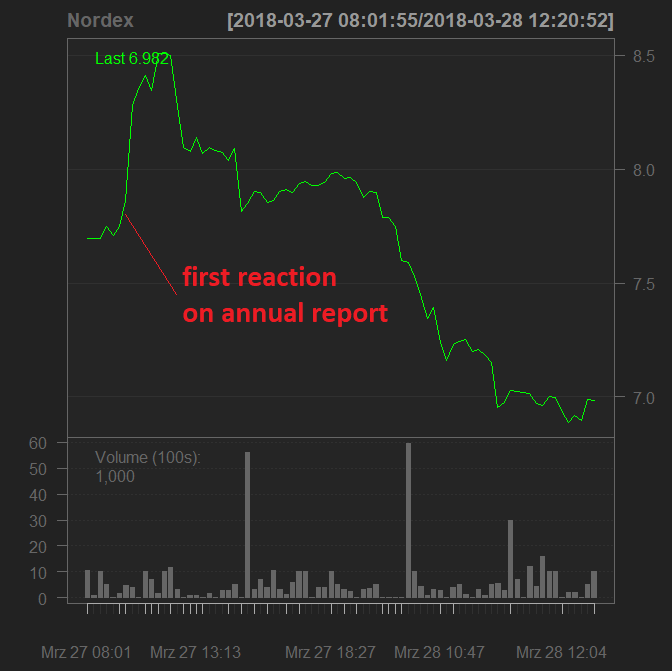

Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy

Nordex SE is one of the leading producers of the wind turbines. Its stock has a long difficult story, being both a tenbagger and a miserable loser. In either case it offers a lot of interesting case studies, one of which is the reaction to the annual report and the bankruptcy of a peer SolarWorld.

Continue reading "Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy"

Continue reading "Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy"

Susan Levermann Strategy – 13 rules that work on the stock market

On the 8 of March, the international Women's Day we review the strategy of Susan Levermann, a highly successful portfolio manager. Hollywood shows the Wall Street as a typically masculine domain. However, Frau Leverman has proven that a smart and persistent vixen may be more successful than an impudent and impatient wall street wolf. Continue reading "Susan Levermann Strategy – 13 rules that work on the stock market"

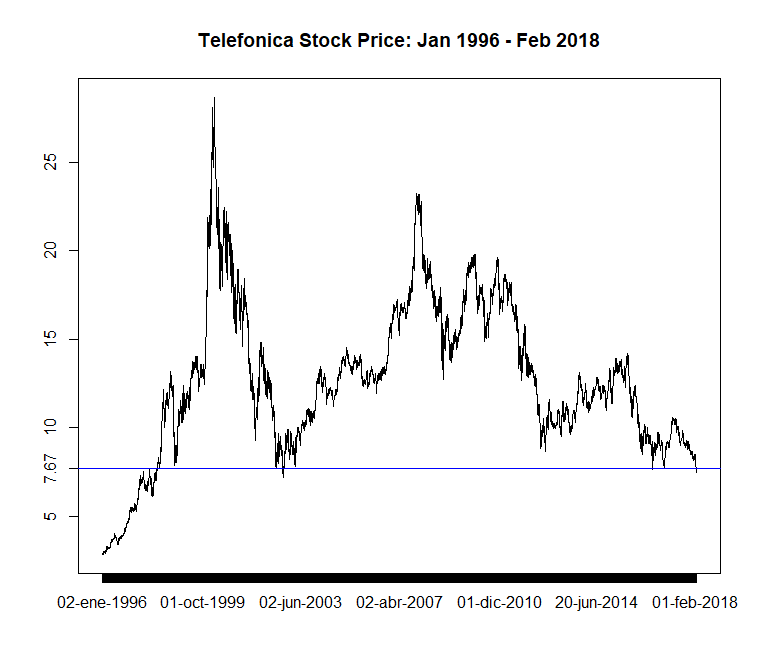

Telefonica (ES0178430E18) – A Trading Chance From Spain

Telefonica a Spanish telecommunication company, one of the largest in the world. It is also very active in Germany (with o2 brand). Telefonica's stock is a component of the Euro Stoxx 50 and currently looks promising both from technical and fundamental points of view. Telefonica always was a good dividend payer, however, there is a pitfall with the Spanish tax at source (Quellensteuer).  Continue reading "Telefonica (ES0178430E18) – A Trading Chance From Spain"

Continue reading "Telefonica (ES0178430E18) – A Trading Chance From Spain"

JuniorDepot 3 – Buying DAX Dividend-Cows

Elle, a 7 years old girl learning to manage her wealth on her own, made her second investment. We used recent market correction to buy an ETF on DivDAX, which consists of the 15 DAX stocks with the highest dividend yield (and mostly low p/e). Continue reading "JuniorDepot 3 – Buying DAX Dividend-Cows"