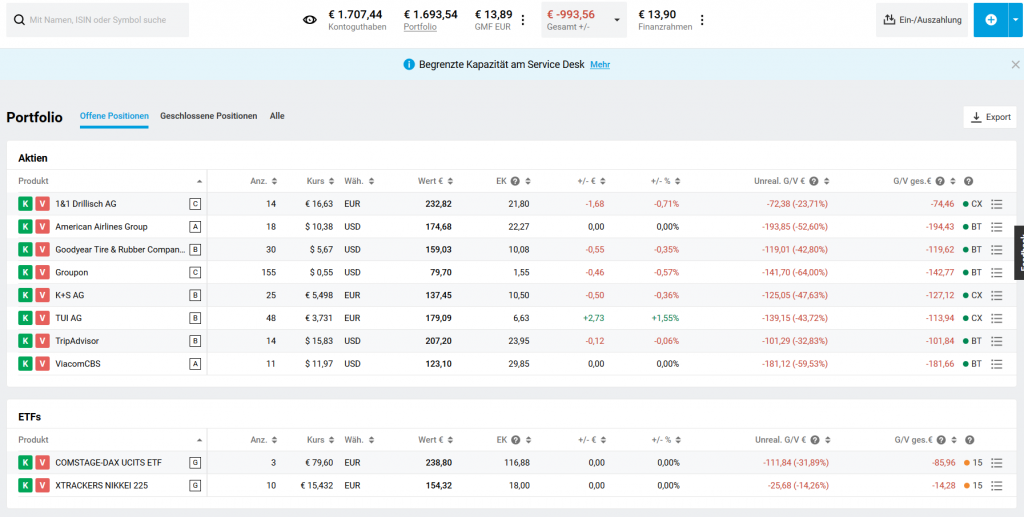

Elle's portfolio stagnates, slipping slightly to loss due to the USD weakness. We were risk averse and missed the (exuberant) growth of the last month. However, after the publication of macroeconomic data the market seems to start oping its eyes. Continue reading "JuniorDepot26 – A Calm Before the Storm"

The Epic Rise and Fall of Wirecard AG – The Money Management View

Wirecard is a German company, which provides e-payment solutions. It grew very rapidly but the fall was even quicker. This case perfectly demonstrates the advantages of diversification and money management. Continue reading "The Epic Rise and Fall of Wirecard AG – The Money Management View"

JuniorDepot25 – Profitable Again

Elle's depot turned back to profitability thanks to recent exuberant market growth. We closed most of our positions and await a drop after a pretty groundless euphoria. Continue reading "JuniorDepot25 – Profitable Again"

JuniorDepot24 – A Gradual Recovery

Elle's timing during the Corona-Crisis was premature and lead to a significant drawdown. However, her depot recovers gradually. We accumulate cash, awaiting the 2nd wave of COVID-19. Continue reading "JuniorDepot24 – A Gradual Recovery"

JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism

Unfortunately we (i.e. I) have misestimated the Corona-Virus impact. Elle's portfolio experiences a severe drawdown. Still we are happy that it happened in the beginning (rather than in the end) of our savings plan.

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

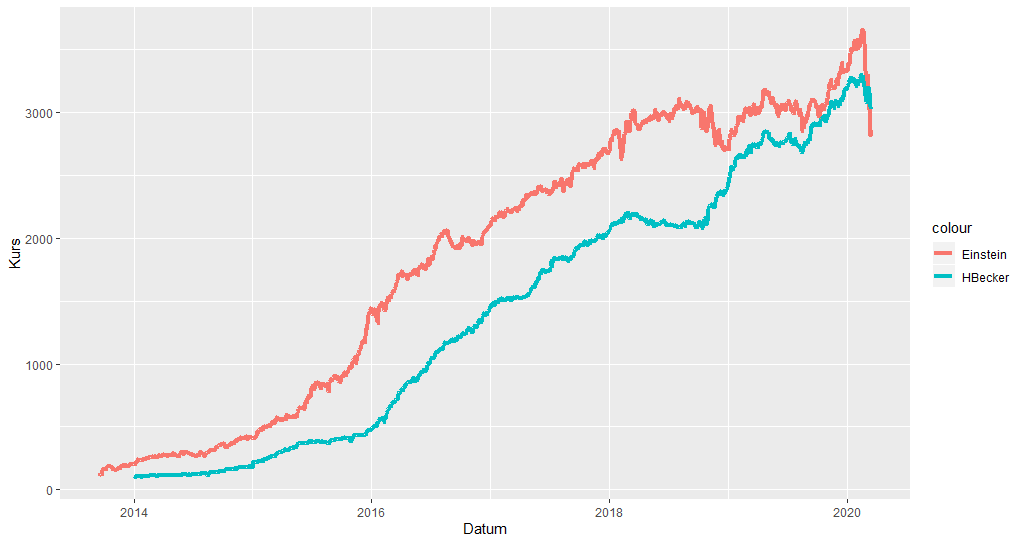

HBecker schlägt Einstein – Risikomanagement zahlt sich aus!

Vor einigen Jahren habe ich die Performance von den besten Wikifolio Tradern Einstein und HBecker analysiert. Mein Verdikt war beide sind besser... und obwohl HBecker (damals) N2 war, wäre er für viele Investoren doch attraktiver im Sinne der risikoadjustierten Performance.

Continue reading "HBecker schlägt Einstein – Risikomanagement zahlt sich aus!"

Continue reading "HBecker schlägt Einstein – Risikomanagement zahlt sich aus!"

JuniorDepot22 – Portfolio Down (a bit) but Mood Up

Having lost the option to invest in ETCs and inverse ETFs, Elle is forced to concentrate on the stockpicking. So far, the result is (a bit) negative but we are quite optimistic for the long run. Continue reading "JuniorDepot22 – Portfolio Down (a bit) but Mood Up"

JuniorDepot21 – Annual Goal for 2019 is Slightly Missed due to Operational Risk

Elle, a 9-year old girl, intended to make at least €220 profit to the end of 2019. She made "only" €215.31 due to an operational mistake, caused by the interface re-design by her broker DeGiro. Continue reading "JuniorDepot21 – Annual Goal for 2019 is Slightly Missed due to Operational Risk"

4. Münchener Tischgespräch von DSW – drei interessante Präsentationen

Auf 4. Münchener Tischgespräch, organisiert am 05.12.2019 vom Deutschen Schutzverein für Wertpapierbesitz e.V. (DSW), hatte ich die Gelegenheit, drei interessante Vorträge von Fraport (ETR:FRA), Biofrontera(NASD:BFRA) und Deutscher Post(ETR:DPW) zu hören. Obwohl ich der quantitative Investor bin, also schaue ich eher auf die Zahlen als auf die Stories, fand ich die Information sehr interessant. Darüber hinaus war es keine Massenveranstaltung, sondern wirklich ein Tischgespräch im engeren Kreis.

Continue reading "4. Münchener Tischgespräch von DSW – drei interessante Präsentationen"

Continue reading "4. Münchener Tischgespräch von DSW – drei interessante Präsentationen"

Teuro Phänomen 2001-2005: War die gefühlte Inflation wirklich falsch? – Eine echte Herausforderung für den Data Scientiest

Wir versuchen das Teuro Phänomen statistisch zu untersuchen und konfrontieren mangelnde und teilweise widersprüchliche Quelldaten. Zwar können wir wegen Datenmangels das Phänomen nicht direkt statistisch nachweisen, spricht die Metaanalysis (also Analyse von zum Thema durchgeführten Studien) eindeutig dafür, das es Teuro doch gab (wenn auch hat sich nicht so offensichtlich ausgeprägt). Continue reading "Teuro Phänomen 2001-2005: War die gefühlte Inflation wirklich falsch? – Eine echte Herausforderung für den Data Scientiest"