It is relatively easy to visualize the aggregated statistics over many periods, e.g. by means of the boxplot series. However, it may be challenging if you want to have a simultaneous look at every element for all time periods. We propose to do it by means of an animated 3D-scatterplot. Continue reading "Visualizing the Fundamental Data on 400 Stocks over 80 Quarters"

Month: May 2018

Classifying Time Series with Keras in R : A Step-by-Step Example

We test different kinds of neural network (vanilla feedforward, convolutional-1D and LSTM) to distinguish samples, which are generated from two different time series models. Contrary to a (naive) expectation, conv1D does much better job than the LSTM. Continue reading "Classifying Time Series with Keras in R : A Step-by-Step Example"

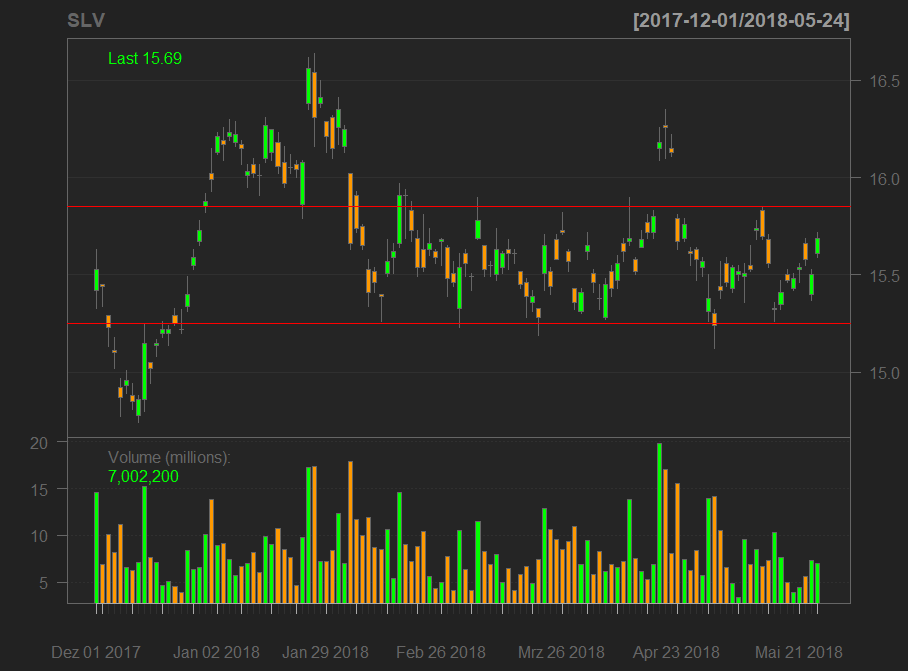

JuniorDepot7 – Buying Silver

The current direction of the stock market remains vague, additionally we remember sell in May and go away. Thus Elle bought silver this time, which also improved the diversification of her portfolio.

Continue reading "JuniorDepot7 – Buying Silver"

Continue reading "JuniorDepot7 – Buying Silver"

R code to detect support and resistance levels

Support and resistance levels are quite popular among traders. Although they are implemented in many apps and services, an open source implementation of the algorithm is hardly available. We try to close the gap.

Continue reading "R code to detect support and resistance levels"

Continue reading "R code to detect support and resistance levels"

JuniorDepot6a – Suboptimal Market Timing and 2nd Stockpicking Attempt with Viacom

Elle keeps practicing to read the charts and recently she found a strong resistance level for DAX at 12600. So we partially went to cash, however, somewhat prematurely. We tried to turn this setback into an opportunity and bought Viacom (VIAB) stocks... which dropped by -6% today. Still we hold it for a fundamentally good investment and will keep the stock. Continue reading "JuniorDepot6a – Suboptimal Market Timing and 2nd Stockpicking Attempt with Viacom"

Wanna be Quant? Probably not anymore after reading this

Since I got asked over and over again how to become a quant, I decided to publish a small essay, going through a letter of my blog reader. I myself managed to change to mathematical finance and risk management from pure software development. I like what I am doing but quant jobs are not as sexy as many young professionals believe. Continue reading "Wanna be Quant? Probably not anymore after reading this"

12 Consistentently Profitable Automatic FX Strategies

We consider 12 most popular and/or mostly discussed fully automated forex trading stratagies on myfxbook.com. This case study clearly shows that it is possible to consistently make money by forex trading. Of course it does not mean that it is easy. Continue reading "12 Consistentently Profitable Automatic FX Strategies"

Optimal Number of Trades: better less but better

A very important question, which every trader or investor encounters is how many trades to commit or how many stocks to hold in portfolio. Whereas the law of the large numbers readily gives a [naive] answer "the more the better", in practice the answer is often better less but better. Continue reading "Optimal Number of Trades: better less but better"