We continue publishing the visualized results from Vasily Nekrasov's research. Reportedly, when Warren Buffett happens to hear complains that there are thousands of stocks to scrutinize, he says "well, start with letter A". We go even further and start with digit 0, since there are (were) suchlike tickers by yahoo.finance. Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [0-9]"

Author: letYourMoneyGrow.com

Volatility Clustering and Piecewise Homoscedasticity – Part I – Indices

This is a well-known fact that the stock prices are virtually unpredictable. However, stock volatilities can more or less be forecasted! In 2012 Vasily Nekrasov scrutinized about 3000 asset price time series, obtained from yahoo.finance. Approximately in half of cases the volatility was piecewise-stationary and thus predicatable. We put online the technical record from 2012 and start publishing the visualized results Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part I – Indices"

DeGiro – Vorsicht vor Währungswechselkosten beim AutoFX

DeGiro ist wohl der günstigste Broker in Deutschland. Allerdings muss man auch bei DeGiro aufpassen. Handelt man auf US-Börsen (und viele [quasi]-kostenlosten ETF sind dort handelbar), fallen die Währungswechselgebühren an! Schlimm ist, dass die nicht explizit ausgewiesen werden! Continue reading "DeGiro – Vorsicht vor Währungswechselkosten beim AutoFX"

letYourMoneyGrow.com Wishes You Happy New Year

Year 2017 was exciting. Markets grew but were very hard, so even Einstein (although he made 30%) says he failed to beat Mr. Market this year. The big question is how 2018 will be, esp. because the market has not seen a correction for a long time. Neither we know the answer but our goal is not to predict the future but rather to help you analyze what may happen. Understanding your own risks and how the numerous rascals may cheat you is essential in trading and investing because there is generally no profit without risk but there are a lot of (idiosyncratic) risks without profit!

We summarize which such risks we have recognized and will continue doing it in 2018.

Continue reading "letYourMoneyGrow.com Wishes You Happy New Year"

The Mon(k)ey Value of BitCoin

The joke about monkey for $10, $20, promise to pay $50, which is currently getting very popular in the Russian segment of Facebook, is not new. It was initially attributed to the Wall Street. However, we decided to re-tell it, because the allusion to BitCoin is even stronger.

Once upon a time in a village in India , a man announced to the villagers that he would buy monkeys BitCoins for $10. Continue reading "The Mon(k)ey Value of BitCoin"

Zinsen gibt es: in der USA

In Deutschland gibt es seit Jahren keine [Anlage-]Zinsen. In EU-Raum bieten zwar die langfristigen Spanischen oder Italienischen Staatsanleihen ca. 3% Rendite an (und die Griechen versprechen sogar ca. 5%), ist diese Risikoprämie wohl nicht umsonst. Darüber hinaus gibt es nicht für jedes EU-Land entsprechenden Anleihen-ETF, auf jeden Fall nicht unter gebührenfreien ETFs von DeGiro.

Gleichzeitig bietet die USA langfristig fast 3% p.a. an und man kann mittels iShares 20+ Year Treasury Bond ETF (ticker TLT) einfach (und durch DeGiro sogar gebührenfrei) investieren. Die Währungsrisiken betrachten wir bei jetzigem Dollarkurs eher als Währungschancen. Die von Fed angekündigte Zinserhöhung ist wohl schon im Kurs berücksichtigt. Continue reading "Zinsen gibt es: in der USA"

Continue reading "Zinsen gibt es: in der USA"

ETF Sparplan: Risiken und Vorteile richtig verstehen

Wir erklären, wie ein Sparplan funktioniert und warum die Mantra „langfristig wird es nach oben gehen“ für einen ETF-Sparplan ungültig ist.

Continue reading "ETF Sparplan: Risiken und Vorteile richtig verstehen"

Continue reading "ETF Sparplan: Risiken und Vorteile richtig verstehen"

Savings Plan Scenario Simulator

Definitely, you have heard a mantra from many asset managers that want your money: in the long term your investment in stocks or an index ETF will grow. Though for a one-time investment it is generally true (however, not always, recall NIKKEI), it is far away from truth for a savings plan. For instance, even if you run your savings plan for 30 years and assume annually 6% expected return and 20% volatility (very optimistic, indeed), you will make losses in ca. 15% of scenarios. And if your saving plan lasts "only" 10 years, the number of scenarios with losses will be about 30%! Additionally, they delude you showing the mean (or expected) scenario. Mean is highly influenced by a couple of extremely good outcomes: finally, your investment cannot fall below zero but there is no upper bound, at least theoretically. That's why the average scenario often looks too optimistic. It is much better to consider the median as the measure of central tendency instead. Try to simulate your savings plan yourself!

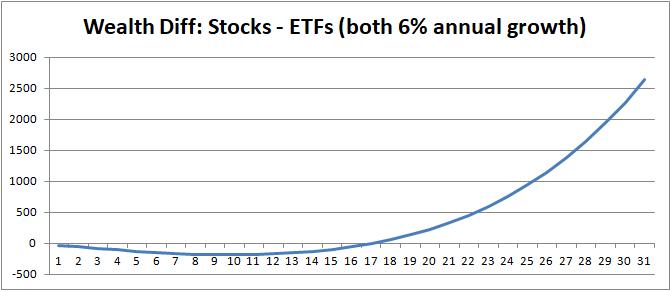

ETFs don’t save (and indeed increase) costs in long term

Apologists of the passive investment claim: stock ETFs save the costs. Indeed they saved costs as broker fees were high. But now they don't, in fact they increase them! Of course sometimes there is no alternative to an ETF/ETC/ETN, e.g. if you want to invest in commodity market. But if you can buy stocks with low broker fees, you should do it directly.

ETF Apologeten behapten: die Aktien-ETF sparen Kosten. Tatsache ist: die sparten die Kosten, als Brokergebühren noch hoch waren. Aktuell ist es nicht mehr der Fall, langfristig sind die Kosten bei den Aktien-ETF sogar höher als beim Direktkauf. Continue reading "ETFs don’t save (and indeed increase) costs in long term"

Continue reading "ETFs don’t save (and indeed increase) costs in long term"

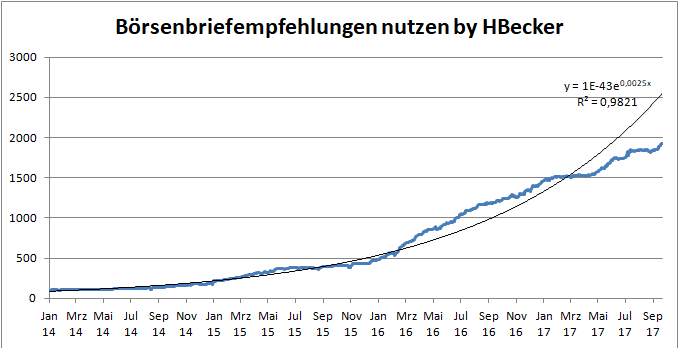

HBecker – another star Trader on Wikifolio

Earlier we analyzed the performance of Einstein, a star trader on Wikifolio who has beaten (and continues to beat) the market. There is one more luminary on Wikifolio - and it is HBecker. Formally, Einstein is Number One in terms of absolute returns (by comparable historical drawdown). However, HBecker has even smoother equity curve and much better hit rate. If you still ask, who is better, the right answer is both are better! We summarize the trading history of HBecker and remind you that Wikifolio is an excellent place to learn from experienced traders but a bad place to invest your money unless you can deeply analyze the risks.

Continue reading "HBecker – another star Trader on Wikifolio"