Whereas the opinions on the usefulness of technical analysis are highly controversial, it is generally agreed that the fundamental analysis does make sense. Value investing, e.g. the choice of companies with low p/e and p/b coefficients but high RoE and EBIT-Margin is not an uncommon approach. However, the data quality and creative data interpretation are critical. Otherwise one yields yet another GiGo: Garbage in, Garbage out! Continue reading "Your Fundamental Analysis is Only as Good as Your Data are: The Example of NWL"

Category: BestPractice

Betriebstrenten sind in Gefahr – Teil II: was tun?

In diesem Folge-Beitrag betrachten wir, was Du – sowohl als Bürger als auch als Einzelperson – gegen die Entwertung der Betriebsrenten machen kannst. Continue reading "Betriebstrenten sind in Gefahr – Teil II: was tun?"

A Fairy Tail or The Magic of Extreme Casino Wins

Michael Shackleford, a who has made a career of analyzing casino games, designed Australian Reels Slot Machine in 2009. In modeling the casino's risk of ruin he (blindly) relied on the normal distribution. We show that this drastically undervalues the tail risk. Continue reading "A Fairy Tail or The Magic of Extreme Casino Wins"

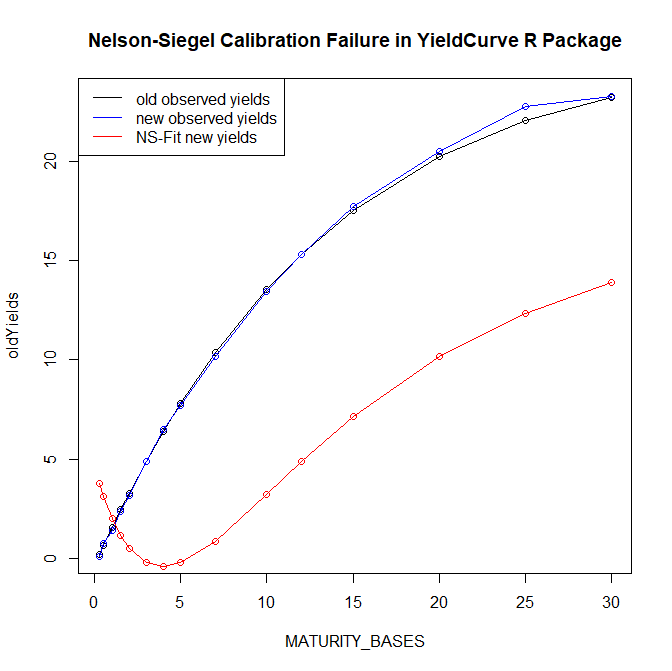

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do

In our previous post on Nelson-Siegel model we have shown some pitfalls of it. In this follow-up we will discuss how to circumvent them and how machine learning and artificial intelligence can[not] help. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part II – what ML and AI can[not] do"

Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I

The Nelson-Siegel-[Svensson] Model is a common approach to fit a yield curve. Its popularity might be explained with economic interpretability of its parameters but most likely it is because the European Central Bank uses it. However, what may do for ECB will not necessarily work in all cases: the model parameters are sometimes extremely unstable and fail to converge. Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

Continue reading "Pitfalls of Nelson-Siegel Yield Curve Modeling – Part I"

JuniorDepot7c – Lots of Actions and Calculations

Market were really turbulent during the last weeks. We committed a lot of trades with Elle and did some important calculations of our trading costs. Continue reading "JuniorDepot7c – Lots of Actions and Calculations"

The Fairest Reward System for a Wealth Manager

In this essay I try to figure out the most fair reward system for a wealth manager. I don't appeal to the notorious utility functions or mathematical optimization models that fail in practice due to the errors of parameter estimation. Rather I rely on best practices and common sense. Continue reading "The Fairest Reward System for a Wealth Manager"

Investor, get rid of information overload!

Retail investors are overwhelmed with information. Meanwhile the payload of these numerous analytics and market reviews is zero or even negative. Is a passive investment in an index ETF a solution to this problem? Yes, but not necessarily the best one. We provide a short list of S&P 500 stocks with good fundamentals, low volatilities and correlations and nice charts from technical point of view. Continue reading "Investor, get rid of information overload!"

Visualizing the Fundamental Data on 400 Stocks over 80 Quarters

It is relatively easy to visualize the aggregated statistics over many periods, e.g. by means of the boxplot series. However, it may be challenging if you want to have a simultaneous look at every element for all time periods. We propose to do it by means of an animated 3D-scatterplot. Continue reading "Visualizing the Fundamental Data on 400 Stocks over 80 Quarters"

12 Consistentently Profitable Automatic FX Strategies

We consider 12 most popular and/or mostly discussed fully automated forex trading stratagies on myfxbook.com. This case study clearly shows that it is possible to consistently make money by forex trading. Of course it does not mean that it is easy. Continue reading "12 Consistentently Profitable Automatic FX Strategies"