Wirecard is a German company, which provides e-payment solutions. It grew very rapidly but the fall was even quicker. This case perfectly demonstrates the advantages of diversification and money management. Continue reading "The Epic Rise and Fall of Wirecard AG – The Money Management View"

Category: BestPractice

Анализ одной фьючерсной стратегии – как следует действовать осторожному инвестору

В сфере управления капиталом часто возникает противоречие - трейдеру нет резона раскрывать детали стратегии, а инвестору рисковано инвестировать в то, что он не понимает. В случае работы через Interactive Brokers сформировался негласный компромис - от трейдера ожидается, что он (по крайней мере) предоставит стандартный детальный отчет IB. На примере стратегии от Юрия Чередниченко мы рассматриваем, что можно (и чего нельзя) почерпнуть из отчетности IB.

Практика показывает, что типичный частный инвестор практически не способен воспринимать результаты статистического анализа, не говоря уж о том чтоб самому провести такой анализ. Поэтому в этот раз мы намеренно обходимся без математики, аппелируя лишь к графикам и здравому смыслу. Continue reading "Анализ одной фьючерсной стратегии – как следует действовать осторожному инвестору"

4. Münchener Tischgespräch von DSW – drei interessante Präsentationen

Auf 4. Münchener Tischgespräch, organisiert am 05.12.2019 vom Deutschen Schutzverein für Wertpapierbesitz e.V. (DSW), hatte ich die Gelegenheit, drei interessante Vorträge von Fraport (ETR:FRA), Biofrontera(NASD:BFRA) und Deutscher Post(ETR:DPW) zu hören. Obwohl ich der quantitative Investor bin, also schaue ich eher auf die Zahlen als auf die Stories, fand ich die Information sehr interessant. Darüber hinaus war es keine Massenveranstaltung, sondern wirklich ein Tischgespräch im engeren Kreis.

Continue reading "4. Münchener Tischgespräch von DSW – drei interessante Präsentationen"

Continue reading "4. Münchener Tischgespräch von DSW – drei interessante Präsentationen"

JuniorDepot18 – Hedging Profit by a Long-Short Lock-in

During a high-turbulence market regime it often makes sense to fix the profit quickly. However, Elle's broker DeGiro provides fee-free trades with the following ETFs only once per months. Elle's trading capital is relatively small so far (€2165), thus paying €2 trading fee shall be avoided whenever possible. So I taught her to lock the profit in long position by means of the respective inverse ETF! Continue reading "JuniorDepot18 – Hedging Profit by a Long-Short Lock-in"

JuniorDepot17 – Fixing Profit for a while

Elle continues growing her wealth, reaching the CAGR of 11.50%. Now she is to learn that keeping a good pace in the long run implies making pauses. Due to political risks and economic concerns in Europe we have, so far, closed all positions in Elle's portfolio.

Continue reading "JuniorDepot17 – Fixing Profit for a while"

Salaries in German IT Branch – a Case Study of Critical Statistics Review

Recently I have read the results of salary survey among Russian-speaking software developers in Germany, published on dou.ua. I was skeptical about the validity of conclusions and expressed my critics (a bit less polite than I should have done it). But the survey author reasonably pointed out that he did his best in his free time and did provide the raw survey data. Recalling a popular motto in Soviet Union: if you are disagree then criticize but if you criticize then do it better I try to interpret the survey results more correctly. Continue reading "Salaries in German IT Branch – a Case Study of Critical Statistics Review"

Historic Black Swans in Historical Financial Data: EQT on 13.11. 2018 et al.

On November 13, 2018 the shares of EQT Corporation (NYSE:EQT) fell down by 46%. Yet, as Montley Fool reported, it was just a spinoff of the midstream assets into a separate public company, Equitrans Midstream Corp... FinViz and eoddata.com has completely failed to depict this event properly. Yahoo.Finance and AlphaVantage coped with it but only to some extent. We discuss the problems, caused by such events and sketch some ways to mitigate them. Continue reading "Historic Black Swans in Historical Financial Data: EQT on 13.11. 2018 et al."

Häuslebau II – Plan B: Bau wird verschoben bzw. sogar aufgehoben

Vor einem Jahr habe ich über den Kauf eines Grundstücks ohne Baupflicht ausführlich berichtet. Ich war damals in der Probezeit (was die Darlehensgenehmigung schwer jedoch nicht unmöglich machte) und mein Plan A war nach der Probezeit mit Hausbau anzufangen. Die Idee war, die monatliche Kaltmiete in die Monatsrate umzuwandeln, was ohne jeglichen Zusatzaufwand ca. €27000 sparen würde. Allerdings hat es mit dem neuen Job nicht rightig geklappt, so kommt nun Plan B: Verkauf des Grundstücks nach dem Ablauf der Spekulationsfrist.

In diesem Beitrag zeigen wir Schritt für Schritt die Kalkulation dieses Plans mittels unseres Quantitatives Toolbox. U.a. zeigen wir, dass der Grundstückerwerb eine bessere Alternative als ein Aktiensparplan war! Continue reading "Häuslebau II – Plan B: Bau wird verschoben bzw. sogar aufgehoben"

The Highest Volatility in October? Don’t trust a Superficial Statistics!

A recent post "Fasten your seat belt for stocks: October is almost here" on MarketWatch, repeated by Morningstar and shared in my social networks may make an illusion that it is likely to expect high(est) volatility in October. A little bit more detailed statistical analysis shows that such expectation is superficial.

A more general (and very old) lesson from this case: the statistical analysis is much more than a primitive consideration of the mean values in groups. And of course: don't trust provoking titles.  Continue reading "The Highest Volatility in October? Don’t trust a Superficial Statistics!"

Continue reading "The Highest Volatility in October? Don’t trust a Superficial Statistics!"

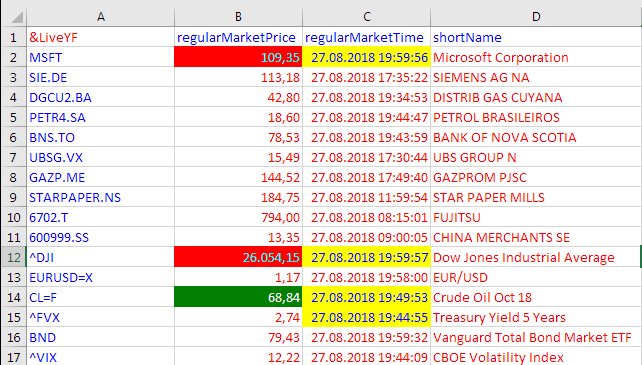

Yahoo Finance Live Feeds in Excel after their API Discontinuation in November 2017

On the fateful Wednesday of November 1st, 2017 Yahoo decided to stop their – until then – free service of delivering real time market data as a text stream through a special URL. For hundreds of businesses and individuals who had relied for years on Yahoo's benevolent free service, this single action meant only one thing: Instant death! Continue reading "Yahoo Finance Live Feeds in Excel after their API Discontinuation in November 2017"