Have you ever thought of being a trader?

I mean trading things like stocks, currencies, options or anything else that you can buy and sell almost instantly - typically online - by pressing a button and not illiquid assets, such as houses or antique furniture.

Wouldn’t it be great to get some sense of what real world trading looks like before setting up an account with an online brokerage firm and putting your own money on risk? Continue reading "Should I use a Trading Simulator to learn how to trade?"

Category: English

The Mon(k)ey Value of BitCoin

The joke about monkey for $10, $20, promise to pay $50, which is currently getting very popular in the Russian segment of Facebook, is not new. It was initially attributed to the Wall Street. However, we decided to re-tell it, because the allusion to BitCoin is even stronger.

Once upon a time in a village in India , a man announced to the villagers that he would buy monkeys BitCoins for $10. Continue reading "The Mon(k)ey Value of BitCoin"

QuantLib for Mere Mortals – Insights from QL User Meeting 2017

We have already used QuantLib at letYourMoneyGrow.com several times, in particular to provide a helpful scenario simulator for option traders. QuantLib User Meeting 2017, in which I also took part, provides insights on how to make QuantLib even more accessible for the "mere mortals".

Continue reading "QuantLib for Mere Mortals – Insights from QL User Meeting 2017"

Savings Plan Scenario Simulator

Definitely, you have heard a mantra from many asset managers that want your money: in the long term your investment in stocks or an index ETF will grow. Though for a one-time investment it is generally true (however, not always, recall NIKKEI), it is far away from truth for a savings plan. For instance, even if you run your savings plan for 30 years and assume annually 6% expected return and 20% volatility (very optimistic, indeed), you will make losses in ca. 15% of scenarios. And if your saving plan lasts "only" 10 years, the number of scenarios with losses will be about 30%! Additionally, they delude you showing the mean (or expected) scenario. Mean is highly influenced by a couple of extremely good outcomes: finally, your investment cannot fall below zero but there is no upper bound, at least theoretically. That's why the average scenario often looks too optimistic. It is much better to consider the median as the measure of central tendency instead. Try to simulate your savings plan yourself!

Oh This Cranky Sentiment: General Electric vs. Daimler on 20.10.2017

Virtually every trader and investor is aware about technical and fundamental analysis. But little understand the importance of sentiment. We consider a case study of GE vs DAI, which particularly good illustrates the importance and interaction of these three components. Continue reading "Oh This Cranky Sentiment: General Electric vs. Daimler on 20.10.2017"

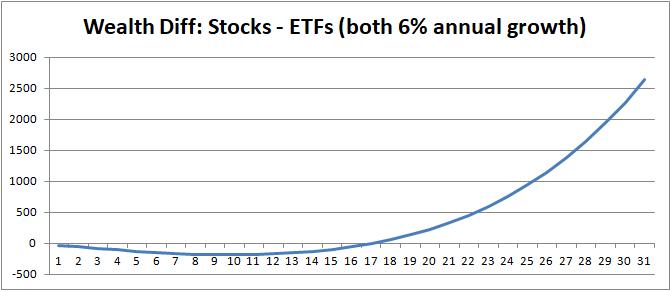

ETFs don’t save (and indeed increase) costs in long term

Apologists of the passive investment claim: stock ETFs save the costs. Indeed they saved costs as broker fees were high. But now they don't, in fact they increase them! Of course sometimes there is no alternative to an ETF/ETC/ETN, e.g. if you want to invest in commodity market. But if you can buy stocks with low broker fees, you should do it directly.

ETF Apologeten behapten: die Aktien-ETF sparen Kosten. Tatsache ist: die sparten die Kosten, als Brokergebühren noch hoch waren. Aktuell ist es nicht mehr der Fall, langfristig sind die Kosten bei den Aktien-ETF sogar höher als beim Direktkauf. Continue reading "ETFs don’t save (and indeed increase) costs in long term"

Continue reading "ETFs don’t save (and indeed increase) costs in long term"

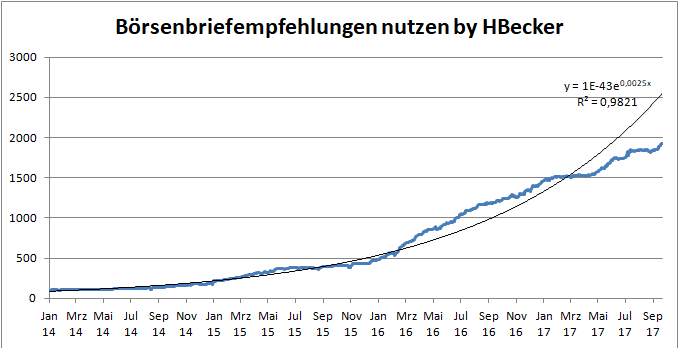

HBecker – another star Trader on Wikifolio

Earlier we analyzed the performance of Einstein, a star trader on Wikifolio who has beaten (and continues to beat) the market. There is one more luminary on Wikifolio - and it is HBecker. Formally, Einstein is Number One in terms of absolute returns (by comparable historical drawdown). However, HBecker has even smoother equity curve and much better hit rate. If you still ask, who is better, the right answer is both are better! We summarize the trading history of HBecker and remind you that Wikifolio is an excellent place to learn from experienced traders but a bad place to invest your money unless you can deeply analyze the risks.

Continue reading "HBecker – another star Trader on Wikifolio"

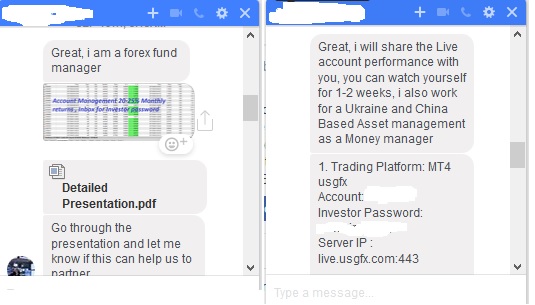

If you got an offer from a Forex Fund Manager

If you got an offer (via a social media) to provide money for an FX managed account and share the profit then you most likely encounter a scammer. However, not always. Recently, we got two offers and by these examples we explain how to distinguish a typical scammer from a trader, who likely does make money. Continue reading "If you got an offer from a Forex Fund Manager"

Continue reading "If you got an offer from a Forex Fund Manager"

Screening DeGiro free ETFs

Yesterday we celebrated our first anniversary and mentioned that we are going to make the asset screening as automatic as possible. But it is a long (or at least mid) term project but time and tide wait for no man. Thus we made for you a manual pre-screening of about 600 ETFs that can be traded on NYSE or NASDAQ via DeGiro without broker fees (except the so-called modality payments, which are though negligible).

Continue reading "Screening DeGiro free ETFs"

letYourMoneyGrow.com is one year (and one day) old!

One year ago we launched letYourMoneyGrow.com and we already can report some achievements!

1. We have created and keep developing our Quantitative Toolbox. In particular, you will not find suchlike Option Calculator with scenario simulation or mortgage calculator with estimation of the interest rate risk anywhere else.

2. Thanks to Einstein, we disproved the stupid mantra that allegedly "nobody can be better than the market". On the other hand we have shown that many "solid" institutional asset managers and [self-proclaimed] stock market "gurus" cannot beat the market. Thus, only track record matters!

3. We have demonstrated, first of all by the example of IREX, how a quantitative performance analysis can help by investment decisions. At least in case of IREX it was clear that the guy will fail and he recently did!

Our next big goal is to automatize the asset screening as much as possible. Continue reading "letYourMoneyGrow.com is one year (and one day) old!"