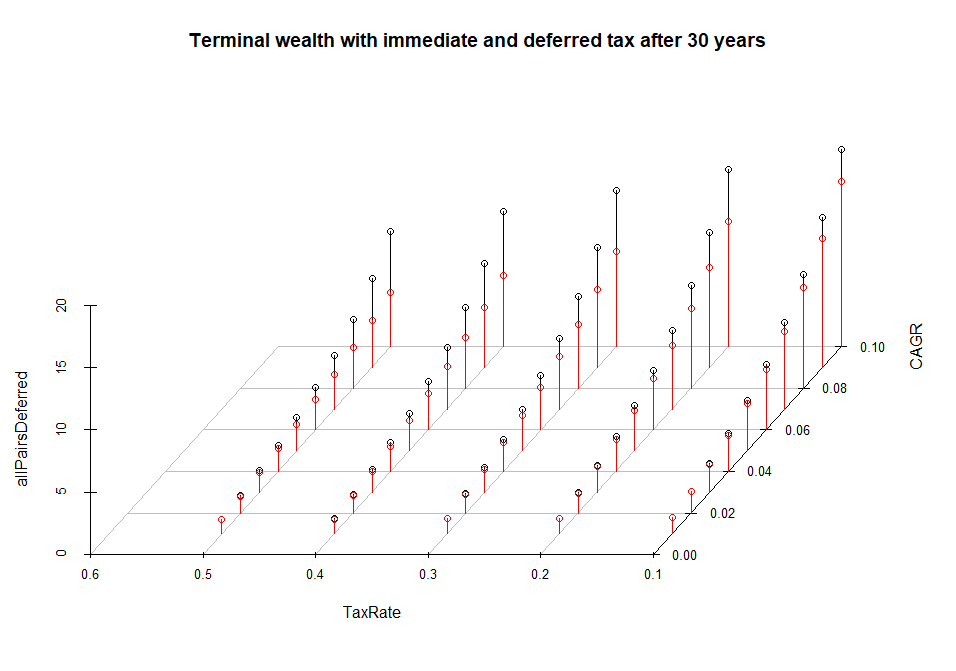

Many investment funds and financial services that want your money argue with a deferred capital yield tax. For instance, in Germany if you trade by yourself, you immediately pay the capital returns tax [Kapitalertragsteuer] (unless the net result of your previous trades is negative). But if you invest in a fund, you don't pay the tax on returns until you sell your share (you still pay a tax on dividends).

We show that though, in general, an investor profits from tax deferral, one should not exaggerate its effect. Moreover, due to annual tax-exempt amounts [Jahresfreibetrag], an immediate taxation can be better than a deferred one.

Continue reading "Numeracy for Traders – Lesson 3 – Ode to Deferred Withholding Tax"

Continue reading "Numeracy for Traders – Lesson 3 – Ode to Deferred Withholding Tax"

Category: English

Tulipmania Deja Vu – Why I don’t trade Cryptocurrencies

Friends of mine ask me why I don't trade the Bitcoin and other cryptocurrencies. Finally, it does not matter what to trade as long as one can make a return. The reason is that indeed I hardly can, since:

1. Contrary to [German] stocks, I don't have such a deep knowledge of cryptocurrencies.

2. Enormous volatility of Bitcoin makes the re-investment of winnings virtually impossible, so one can achieve only linear, not an exponential growth by active trading.

3. I have a strong allergy when something clearly resembles a tulipmania or a Ponzi scheme.

4. Theoretically a blockchain cannot be forged but in practice there are implementation bugs. And technical limitations (which recently might have caused the split of Bitcoin in two currencies).

Continue reading "Tulipmania Deja Vu – Why I don’t trade Cryptocurrencies"

Contango and Cash: the rollover costs are not always prohibitive

As we published our recommendation to invest in commodities, we got a remark that we should not neglect the contango effect and rollover costs. So we analyzed them and came to a conclusion that although the costs of futures rolling (and ETF fees) are not negligible, they are also not so important, compared to the recent movements of commodity prices.

There were ten futures for the nearest months

Roll over, roll over.

And the January futures was to expire

Nine!

Continue reading "Contango and Cash: the rollover costs are not always prohibitive"

Seeking Alpha and finding nonsense – never trust CAPM and linear regression blindly

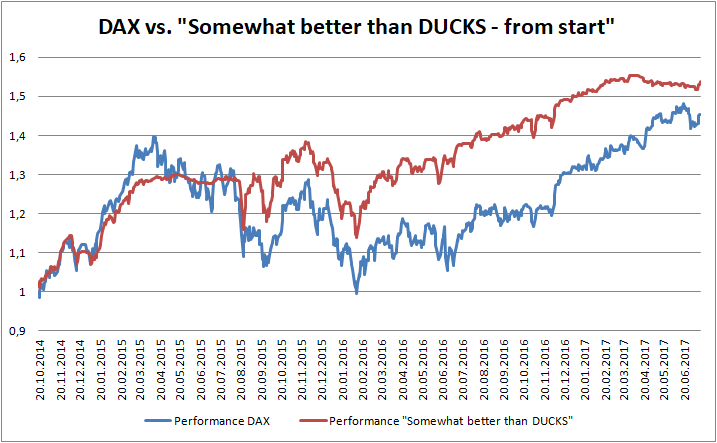

I show by the example of my portfolio "somewhat better than DUCKS" that CAPM alpha is a very non-robust measure of performance as well as that linear regression on an index should be considered very critically.

Recently, one of my facebook contacts has meant that my portfolio "Somewhat better than DUCKS" repeats the DAX with a beta but without alpha. He even did not make an effort to calculate the linear regression before making this statement. However, even if he did, the results would not be comprehensive.

Continue reading "Seeking Alpha and finding nonsense – never trust CAPM and linear regression blindly"

Market Spotlight: Pick up Commodities but be picky

Currently the stocks are expensive and the commodities are cheap (though not all of them). We conduct a lite analysis of investment opportunities and construct a mid-term commodity portfolio for a retail investor with €10000+ capital. Continue reading "Market Spotlight: Pick up Commodities but be picky"

R-script for Fixer.io – get FX rates in R for 31 currencies

Even if you are not a Forex trader, it is often necessarily to get currency exchange rates, e.g. if you trade [the options on] foreign stocks. Fixer.io provides daily FX-rates from European Central Bank for 31 currencies via JSON API. We present a script to get data in R.

Continue reading "R-script for Fixer.io – get FX rates in R for 31 currencies"

YaWhore Dance with Yahoo Finance

On 17.04.2017 Yahoo.Finance changed its API, so ichart.finance.yahoo.com is (temporarily?!) unavailable. In particular it means that many R-scripts that rely on quantmod/getSymbols() will not function anymore. We discuss the ways to circumvent the API change of Yahoo.Finance and alternatives to it, esp. Alpha Vantage.

Continue reading "YaWhore Dance with Yahoo Finance"

Continue reading "YaWhore Dance with Yahoo Finance"

Integrating QuantLib with R and Web – Barrier Options Pricer

Some of QuantLib functionality is ported to R in RQuantLib. In particular the pricing of Barrier options. Unfortunately, only European. But we need American in order to price and simulate future scenarios for the so-called KO-Zertifikate (Knock-Out Warrants), which are quite popular among German retail traders. We show how to quickly adopt the code from QuantLib testsuite, compile it under Linux and integrate with R and web.

Continue reading "Integrating QuantLib with R and Web – Barrier Options Pricer"

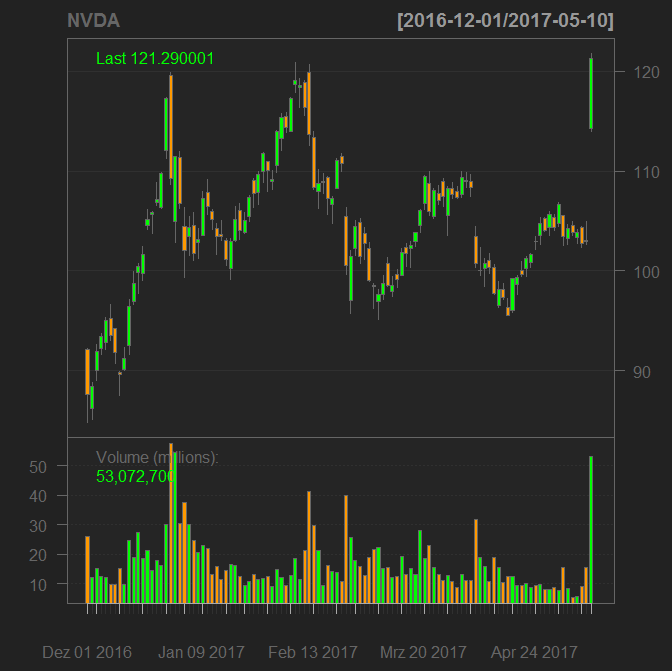

PUT on nVIDIA turned out to be far from perfect trade, but…

On 25.12.2016 I bought a put on nVIDIA since I found the stock extremely overpriced. I called it "nearly perfect trading decision", inter alia, because the implied volatility was though plausible but still high. Yesterday after the publication of Q1 financial report the stock jumped 18%. My put option is about 50% down since purchase time. But due to a strict money management I have capital for the 2nd and even fors 3rd attempt and I still consider nVIDIA as heavily overpriced.

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Portfolio Simulator – estimate the expected risk and return of your investments

Our simulator allows you to simulate 100 future scenarios of your portfolios, estimate the expected risk, return and correlations, helping you to improve the diversification of your portfolios. The simulator projects the historical returns in future and is completely model-free (in particular, we don't make an unrealistic assumption of Normally-distributed returns). Though the past doesn't capture all possible future scenarios, it provides a good idea of possible outcomes.

Continue reading "Portfolio Simulator – estimate the expected risk and return of your investments"