Elle's depot turned back to profitability thanks to recent exuberant market growth. We closed most of our positions and await a drop after a pretty groundless euphoria. Continue reading "JuniorDepot25 – Profitable Again"

Category: English

JuniorDepot24 – A Gradual Recovery

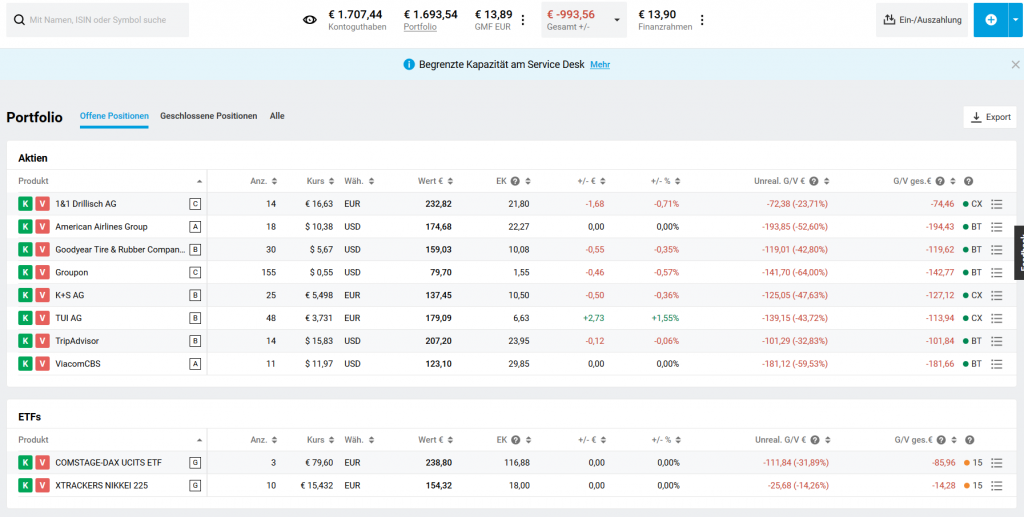

Elle's timing during the Corona-Crisis was premature and lead to a significant drawdown. However, her depot recovers gradually. We accumulate cash, awaiting the 2nd wave of COVID-19. Continue reading "JuniorDepot24 – A Gradual Recovery"

JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism

Unfortunately we (i.e. I) have misestimated the Corona-Virus impact. Elle's portfolio experiences a severe drawdown. Still we are happy that it happened in the beginning (rather than in the end) of our savings plan.

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

JuniorDepot22 – Portfolio Down (a bit) but Mood Up

Having lost the option to invest in ETCs and inverse ETFs, Elle is forced to concentrate on the stockpicking. So far, the result is (a bit) negative but we are quite optimistic for the long run. Continue reading "JuniorDepot22 – Portfolio Down (a bit) but Mood Up"

JuniorDepot21 – Annual Goal for 2019 is Slightly Missed due to Operational Risk

Elle, a 9-year old girl, intended to make at least €220 profit to the end of 2019. She made "only" €215.31 due to an operational mistake, caused by the interface re-design by her broker DeGiro. Continue reading "JuniorDepot21 – Annual Goal for 2019 is Slightly Missed due to Operational Risk"

JuniorDepot20 – Second Intermediate Goal is [Almost] Reached

Elle, a nine years old girl, who manages her wealth with our help, has hit (ahead of time) her target for the 2nd year: to earn at least 220 EUR.

In future she has to alter her investing strategy a little bit since on the one hand her broker DeGiro introduces flat-fee trading with American stocks but on the other hand will compensate the negative rates only upto 2500 EUR cash. Continue reading "JuniorDepot20 – Second Intermediate Goal is [Almost] Reached"

JuniorDepot19 – Excellent Performance Despite The Market Dip

Elle, a eight nine years old girl has reached an excellent investment result in August 2019 despite the market dip. Discipline, diversification and of course some luck were ingredients of her success. Continue reading "JuniorDepot19 – Excellent Performance Despite The Market Dip"

JuniorDepot18 – Hedging Profit by a Long-Short Lock-in

During a high-turbulence market regime it often makes sense to fix the profit quickly. However, Elle's broker DeGiro provides fee-free trades with the following ETFs only once per months. Elle's trading capital is relatively small so far (€2165), thus paying €2 trading fee shall be avoided whenever possible. So I taught her to lock the profit in long position by means of the respective inverse ETF! Continue reading "JuniorDepot18 – Hedging Profit by a Long-Short Lock-in"

JuniorDepot17 – Fixing Profit for a while

Elle continues growing her wealth, reaching the CAGR of 11.50%. Now she is to learn that keeping a good pace in the long run implies making pauses. Due to political risks and economic concerns in Europe we have, so far, closed all positions in Elle's portfolio.

Continue reading "JuniorDepot17 – Fixing Profit for a while"

Reading A First Course in Quantitative Finance by Thomas Mazzoni

A First Course in Quantitative Finance by Thomas Mazzoni was published a year ago. It provides a thorough analysis of such topics as Local Volatility, derivative pricing via PDEs (and solution of theses PDEs) as well as a good insight of Levy processes. Although it might be too big and too general for the 1st course, it is definitely worth reading as the 1.5* course in quantitative finance. Continue reading "Reading A First Course in Quantitative Finance by Thomas Mazzoni"