Since we did not report about Elle's progress for more than a year, the readers of letYourMoneyGrow.com might have thought that we have terminated our experiment of growing a 7 (currently 11) years young girl as an investor. Nope, not at all! As a matter of fact we worked hard on creation and test of a deep neural network for the stock (pre)selection. And it did work, our CAGR goal is (over)achieved!

Continue reading "JuniorDepot29 – (Over)archieving the Financial Plan (thanks to AI and NI)"

GPUs in AI – are they always cool? No, sometimes they are hot!

Finally I harnessed Tesla K80 for my AI modeling but unfortunately the overheat brings much overheads and not by all models the GPU is superior over CPU. Continue reading "GPUs in AI – are they always cool? No, sometimes they are hot!"

Affordable Hardware for Stockpicking AI – BeerWulf’s eBay Adventure

In my previous post I reported howto build and install TensorFlow and horovod from sources and howto setup a BeerWulf (BeoWulf) cluster. Building this BeerWulf cluster is though a good exercise to make a (resilient) system of a commodity hardware, however, it is not the most efficient way for a practical purpose (in my case: for creating an AI model, which helps me to pick up stocks). In this post I consider the hardware alternatives in the sense of making them both as efficient and as cheap as possible. Continue reading "Affordable Hardware for Stockpicking AI – BeerWulf’s eBay Adventure"

Building TensorFlow 2.5 (CPU only) and Horovod from source in Ubuntu 20.04.2 LTS

Short summary:

sudo swapoff /swapfile

sudo dd if=/dev/zero of=/swapfile bs=1M count=65536 oflag=append conv=notrunc

sudo mkswap /swapfile

sudo swapon /swapfile

sudo update-alternatives --install /usr/bin/python python /usr/bin/python3 1

sudo apt update

sudo apt install python3-dev python3-pip

sudo apt install python3-testresources

pip install -U --user pip numpy==1.19.5 wheel

pip install -U --user keras_preprocessing --no-deps

sudo apt install git

git clone https://github.com/tensorflow/tensorflow.git

cd tensorflow

git checkout r2.5

sudo apt install npm

sudo npm install -g @bazel/bazelisk

./configure

bazel build --config=opt //tensorflow/tools/pip_package:build_pip_package

./bazel-bin/tensorflow/tools/pip_package/build_pip_package /tmp/tensorflow_pkg

pip install /tmp/tensorflow_pkg/tensorflow-2.5.0-cp38-cp38-linux_x86_64.whl

sudo apt-get install openssh-server

sudo systemctl enable ssh

sudo systemctl start ssh

ssh-keygen

ssh-copy-id vasily@SERVER2

ssh SERVER2

ssh-keygen

ssh-copy-id vasily@SERVER1

sudo snap install cmake --classic

sudo apt install openmpi-bin

mpirun -H SERVER1:1,SERVER2:1 hostname

git clone --recursive https://github.com/uber/horovod.git

cd horovod

python setup.py clean

python setup.py bdist_wheel

HOROVOD_WITH_TENSORFLOW=1 pip install ./dist/horovod-0.22.1-cp38-cp38-linux_x86_64.whl[tensorflow,keras]

mpirun -H SERVER1:3,SERVER2:3 python3 /home/vasily/horovod/examples/tensorflow2/tensorflow2_keras_mnist.py

Continue reading "Building TensorFlow 2.5 (CPU only) and Horovod from source in Ubuntu 20.04.2 LTS"

Howto Install Tensorflow-GPU with Keras in R – A manual that worked on 2021.02.20 (and likely will work in future)

A brief instruction:

0. Update your Nvidia graphic card driver (just driver; you need NOT install/update CUDA but make sure that your card has cuda compute capability >= 3.5)

1. install Anaconda (release Anaconda3-2020.11 from anaconda.org)

2. open anaconda prompt and run

>conda create -n tfgpu210p37 python==3.7

>conda activate tfgpu210p37

>conda install cudatoolkit=10.1 cudnn=7.6 -c=conda-forge

>conda install -c anaconda tensorflow-gpu

3. in R run

>install.packages("keras")

>reticulate::use_condaenv("tfgpu210p37", required = TRUE)

>library(keras)

4. If you wanna understand what is going on under the hood, read further

Continue reading "Howto Install Tensorflow-GPU with Keras in R – A manual that worked on 2021.02.20 (and likely will work in future)"

Häusle oder Aktien? – Die Antwort gibt es aber man muss immer adhoc berechnen

Am häufigsten kommen zwei Empfehlungsarten von "Experten" vor: entweder in die Aktien zu investieren weil sie eine höhere erwartete Rendite bringen oder die Immobilien zu kaufen weil die stabiler sind.

Beide Aussagen sind lediglich ein kleiner Teil der komplizierten Wahrheit. In diesem Post zeigen wir anhand eines Beispiels, wie man - mittels Zahlen und Berechnungen - eine mehr oder weniger vollständige Antwort für seinen persönlichen Fall bekommen kann.

Sehr hilfreich dafür ist das kostenlose Toolset von letYourMoneyGrow.com Continue reading "Häusle oder Aktien? – Die Antwort gibt es aber man muss immer adhoc berechnen"

Interbreeding R and Python to Give Birth to an Optimal German Mortgage

In many countries a mortgage shall be completely redeemed to the end of its duration and may be refinanced anytime. In USA one additionally can foreclose his mortgage by mailing his house-keys to a bank. In Germany is different.

First of all, one may completely refinance a mortgage only after 10 years (otherwise one have to pay Vorfälligkeitsentschädigung - a compensation to a bank for missed interest). But taking a long-term mortgage (20 or 30 years) implies a higher mortgage rate, thus it is not uncommon to take several consequent 10- (or sometimes even 5-) year mortgages. In order to optimize mortgage costs / rate change risk relation one can take several submortgages with different durations. Last but not least there is no requirement to amortize a mortgage completely: normally one refinances the residual debt (Restschuld) with a follow-up mortgage (Anschlussfinanzierung).

In this post we discuss the challenges of mortgage optimization and show how two popular programming languages - R and Python - can help us together Continue reading "Interbreeding R and Python to Give Birth to an Optimal German Mortgage"

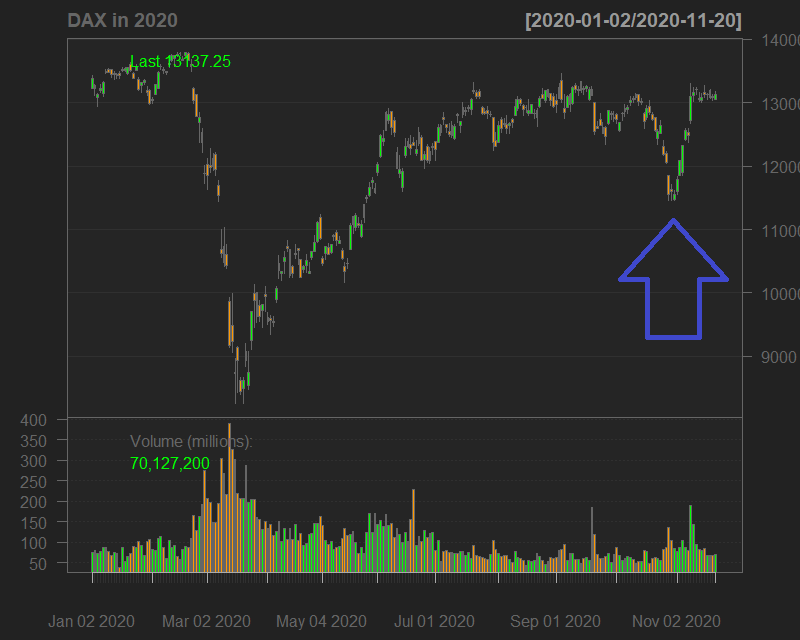

JuniorDepot28 – Catching-Up the Target CAGR and Beating the DAX

DAX, the German main stock index, fell on the 2nd lockdown in October but quickly recovered in November 2020. Elle made use of this movement, both achieving her target rate of return and beating the DAX. Continue reading "JuniorDepot28 – Catching-Up the Target CAGR and Beating the DAX"

Continue reading "JuniorDepot28 – Catching-Up the Target CAGR and Beating the DAX"

Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality

A pig will find the dirt (Russian proverb). The market will find reasons to grow. To fall as well. It is worth documenting (and periodically recalling) what happened on 9/11/2000 (as well as shortly before and after this date).

In the end of October the German market was not in the mood, upset by the 2nd (partial) lockdown. However, after a healthy DAX correction, the greed got started to dominate again. On November the 9th two really(?) good news arrived: first the preliminary victory of Joe Biden, followed by 90% efficiency of Pfizer/BioNtech vaccine.

Continue reading "Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality"

Continue reading "Pfizer/BioNtech and Covid-impacted stocks on 9/11/2020 and afterwards – yet another market irrationality"

JuniorDepot27 – Profitable but Still Worse than DAX, so far…

Last weeks Elle was inactive, patiently waiting for an opportunity to buy cheaply. It came with a "common" September correction. Still Elle stays very cautious because this time the October (the most volatile month on average) will definitely be extremely volatile due to President elections in USA. Continue reading "JuniorDepot27 – Profitable but Still Worse than DAX, so far…"