Let your money grow

Stock mark’t is tough and turbulent

Let your money grow

Your risks by every trade,

Estimate risk-reward and

Let your money grow

Continue reading "Grow your money, Trader – the Anthem of letYourMoneyGrow.com"

Continue reading "Grow your money, Trader – the Anthem of letYourMoneyGrow.com"

German residential market is booming due to extremely low interest rates and, respectively, very cheap mortgages. But if the rates grow, the market is going to crash! For instance, a current rate for 10 year mortgage without a downpayment is about 2%. A new rural house costs about €300000. A typical borrower can pay about €1000 monthly installment + €5000 extra redemption in the end of year. If the rate jumps to 4%, the house price will drop to €246303, i.e. 17.9% (this is just estimation, however, it is not implausible). And additionally the residual debt refinancing costs will increase by €31762 (this is a precise calculation).

Continue reading "Why German real estate market will likely crash"

Zinsänderungsrisiko ist aktuell so hoch wie noch nie! Die Kredite sind wegen extrem niedriger Zinsen zwar günstig geworden, aber die starke Nachfrage trieb die Immobilienpreise so hoch, dass barwertig gesehen, ist der Erwerb einer Immobilie doch teuerer geworden. Und wenn Sie dazu Ihre Immobilie nicht auf einmal, sondern mit dem Anschlusskredit finanzieren, kann die Restschuld für Sie sehr teuer werden. Selber Schuld, wenn Sie Ihre Risiken nicht nachkalkulieren (letYourMoneyGrow.com hilft Ihnen gerne bei Kalkulation).

Zinsänderungsrisiko ist aktuell so hoch wie noch nie! Die Kredite sind wegen extrem niedriger Zinsen zwar günstig geworden, aber die starke Nachfrage trieb die Immobilienpreise so hoch, dass barwertig gesehen, ist der Erwerb einer Immobilie doch teuerer geworden. Und wenn Sie dazu Ihre Immobilie nicht auf einmal, sondern mit dem Anschlusskredit finanzieren, kann die Restschuld für Sie sehr teuer werden. Selber Schuld, wenn Sie Ihre Risiken nicht nachkalkulieren (letYourMoneyGrow.com hilft Ihnen gerne bei Kalkulation).

Continue reading "Warum Sie äußerst vorsichtig beim Immobilienkauf sein müssen"

Continue reading "Anti-Asimov’s Three Laws of Robo-Advisory"

Donald Trump's victory on 09.11.2016 was likely as surprising for markets as Brexit was. However, the expected (and factual) aftermath was completely different. This case is good to learn when you should urgently sell and when not Continue reading "Trump trade: case study of DAX intraday on 09.11.2016"

Continue reading "Trump trade: case study of DAX intraday on 09.11.2016"

Recently we revied the performance of Einstein, a German trader who managed (without a leverage) to make almost 2000% in less than three years. LetYourMoneyGrow.com translates his investment grades in layman's terms:

As I read Oleg Barmin's book "Я помню всех, кто мне когда-то не перезвонил" (I remember everybody who once did not call me back) I saw a lot of parallel to Theodore Dreiser's Financier Frank Cowperwood (Charles Yerkes). Like Cowperwood (who being a teenager bought and re-sold a soap with profit), teeny Barmin bought a frozen fish, smoked it and re-sold with profit. In the age of 21 he built a flourishing car business ... and like Cowperwood was wiped by crisis and was imprisoned (however, only on remand). Like Cowperwood, he rose again (in florist business). Though Barmin had not (yet) built something like London Subway, he is only 35 and who knows, maybe we will see more parallels with Cowperwood...

As I read Oleg Barmin's book "Я помню всех, кто мне когда-то не перезвонил" (I remember everybody who once did not call me back) I saw a lot of parallel to Theodore Dreiser's Financier Frank Cowperwood (Charles Yerkes). Like Cowperwood (who being a teenager bought and re-sold a soap with profit), teeny Barmin bought a frozen fish, smoked it and re-sold with profit. In the age of 21 he built a flourishing car business ... and like Cowperwood was wiped by crisis and was imprisoned (however, only on remand). Like Cowperwood, he rose again (in florist business). Though Barmin had not (yet) built something like London Subway, he is only 35 and who knows, maybe we will see more parallels with Cowperwood...

In spite of such praising summary the post is going to be critical: we will concentrate on what Oleg missed from risk management point of view.

Continue reading "A Russian Frank Cowperwood: Oleg Barmin’s case from risk management point of view"

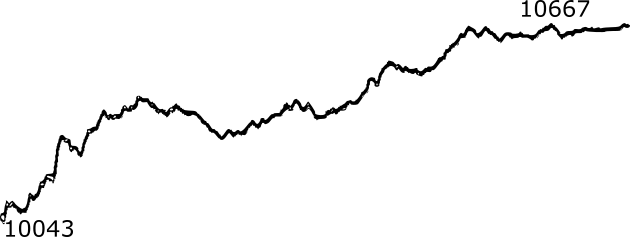

My wikifolio ("Somewhat better than DUCKS", ISIN: DE000LS9HDK3) is investable from 28.10.2016. It surely beats the DAX (main German stock index) both on absolute and risk-adjusted performance. Though I am very proud of my performance, I provide a closer look at it and show that sometimes I had just luck and sometimes I could have done better. I always preach for the rigorous and cold-blooded performance analysis and the best sermon is to demonstrate it by the example of myself.

Continue reading "My Fund Somewhat better than DUCKS is 1 year old: a festive but fair review"

Summary: