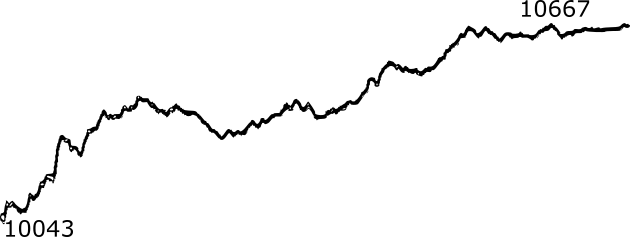

German residential market is booming due to extremely low interest rates and, respectively, very cheap mortgages. But if the rates grow, the market is going to crash! For instance, a current rate for 10 year mortgage without a downpayment is about 2%. A new rural house costs about €300000. A typical borrower can pay about €1000 monthly installment + €5000 extra redemption in the end of year. If the rate jumps to 4%, the house price will drop to €246303, i.e. 17.9% (this is just estimation, however, it is not implausible). And additionally the residual debt refinancing costs will increase by €31762 (this is a precise calculation).

Continue reading "Why German real estate market will likely crash"

Zinsänderungsrisiko ist aktuell so hoch wie noch nie! Die Kredite sind wegen extrem niedriger Zinsen zwar günstig geworden, aber die starke Nachfrage trieb die Immobilienpreise so hoch, dass barwertig gesehen, ist der Erwerb einer Immobilie doch teuerer geworden. Und wenn Sie dazu Ihre Immobilie nicht auf einmal, sondern mit dem Anschlusskredit finanzieren, kann die Restschuld für Sie sehr teuer werden. Selber Schuld, wenn Sie Ihre Risiken nicht nachkalkulieren (letYourMoneyGrow.com hilft Ihnen gerne bei Kalkulation).

Zinsänderungsrisiko ist aktuell so hoch wie noch nie! Die Kredite sind wegen extrem niedriger Zinsen zwar günstig geworden, aber die starke Nachfrage trieb die Immobilienpreise so hoch, dass barwertig gesehen, ist der Erwerb einer Immobilie doch teuerer geworden. Und wenn Sie dazu Ihre Immobilie nicht auf einmal, sondern mit dem Anschlusskredit finanzieren, kann die Restschuld für Sie sehr teuer werden. Selber Schuld, wenn Sie Ihre Risiken nicht nachkalkulieren (letYourMoneyGrow.com hilft Ihnen gerne bei Kalkulation).