QuantLib development often lags the version of Visual Studio. Thus you need to do some manual tuning to build QL v1.14 in VS 2019. Generally, if you can, you shall so far stay by VS2017. Continue reading "Building QuantLib 1.14 with Visual Studio 2019 preview"

JuniorDepot13 – Things are getting better as the markets recover

As we have previously reported, the year 2018 was not very good for Elle's portfolio, indeed it was bad. But we looked optimistically in future and were right: the portfolio recovers with the market and the opportunities for the active trading arise. Continue reading "JuniorDepot13 – Things are getting better as the markets recover"

Salaries in German IT Branch – a Case Study of Critical Statistics Review

Recently I have read the results of salary survey among Russian-speaking software developers in Germany, published on dou.ua. I was skeptical about the validity of conclusions and expressed my critics (a bit less polite than I should have done it). But the survey author reasonably pointed out that he did his best in his free time and did provide the raw survey data. Recalling a popular motto in Soviet Union: if you are disagree then criticize but if you criticize then do it better I try to interpret the survey results more correctly. Continue reading "Salaries in German IT Branch – a Case Study of Critical Statistics Review"

JuniorDepot12 – DAX, Silver, Oil: pessimistic end of year and optimistic sentiment for future

By Elle's portfolio we implicitly target the CAGR of 6%. Alas, this year the CAGR turned out to be -24.7%! Especially our recent portfolio restructuring (sell Silver and buy DAX and WTI Oil) was not good.

Still we are better than a passive savings plan in DAX (this would have a CAGR of -30.7%) and look optimistically in future. Especially pleasant was Elle's reaction on the (temporary) drawdown: calm and stoic. This a necessarily trait for a growing Warren Buffet. Continue reading "JuniorDepot12 – DAX, Silver, Oil: pessimistic end of year and optimistic sentiment for future"

PCA, Autoencoders and the Feasibility of Stockpicking

The idea that the stock picking makes less and less sense since the markets are more and more driven by the macroeconomic factors is quite popular.

Especially right now, as the markets are falling (like on todays FEd decision to increase the rates), this idea may seem to be plausible. However, we show that in the long term the stocks do show enough of individuality. Continue reading "PCA, Autoencoders and the Feasibility of Stockpicking"

Historic Black Swans in Historical Financial Data: EQT on 13.11. 2018 et al.

On November 13, 2018 the shares of EQT Corporation (NYSE:EQT) fell down by 46%. Yet, as Montley Fool reported, it was just a spinoff of the midstream assets into a separate public company, Equitrans Midstream Corp... FinViz and eoddata.com has completely failed to depict this event properly. Yahoo.Finance and AlphaVantage coped with it but only to some extent. We discuss the problems, caused by such events and sketch some ways to mitigate them. Continue reading "Historic Black Swans in Historical Financial Data: EQT on 13.11. 2018 et al."

JuniorDepot11 – Speculating with DAX and WTI Oil

Elle, a 8-years old girl, who learns to manage her wealth, got started to trade more and more intensively. During the current market turbulence it actually makes sense. This time we speculate with an oil-ETC and learn the nuances of commodity trading. Continue reading "JuniorDepot11 – Speculating with DAX and WTI Oil"

Häuslebau II – Plan B: Bau wird verschoben bzw. sogar aufgehoben

Vor einem Jahr habe ich über den Kauf eines Grundstücks ohne Baupflicht ausführlich berichtet. Ich war damals in der Probezeit (was die Darlehensgenehmigung schwer jedoch nicht unmöglich machte) und mein Plan A war nach der Probezeit mit Hausbau anzufangen. Die Idee war, die monatliche Kaltmiete in die Monatsrate umzuwandeln, was ohne jeglichen Zusatzaufwand ca. €27000 sparen würde. Allerdings hat es mit dem neuen Job nicht rightig geklappt, so kommt nun Plan B: Verkauf des Grundstücks nach dem Ablauf der Spekulationsfrist.

In diesem Beitrag zeigen wir Schritt für Schritt die Kalkulation dieses Plans mittels unseres Quantitatives Toolbox. U.a. zeigen wir, dass der Grundstückerwerb eine bessere Alternative als ein Aktiensparplan war! Continue reading "Häuslebau II – Plan B: Bau wird verschoben bzw. sogar aufgehoben"

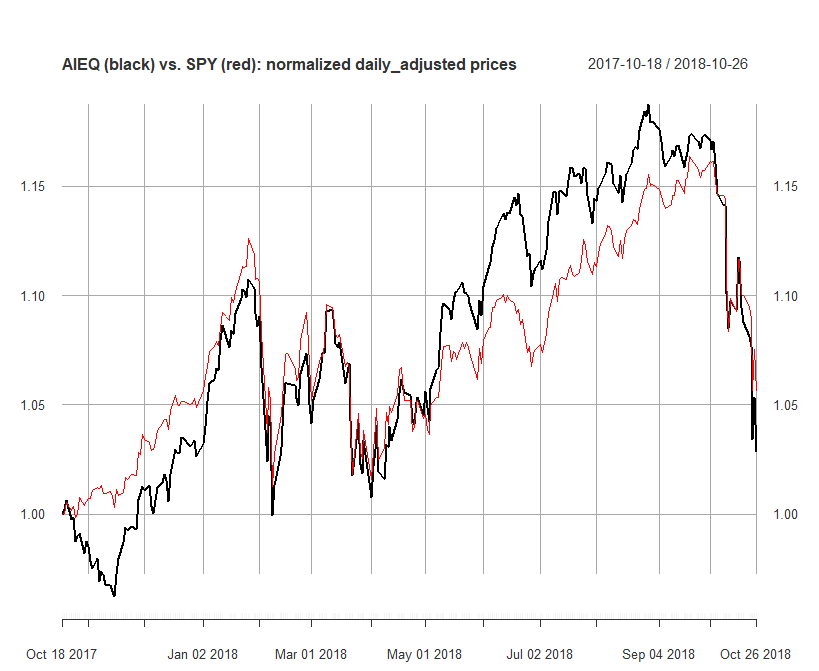

AIEQ the AI Powered Equity ETF: Artificial Intelligence is Still Losing to a Natural Stupidity

A year ago the Business Insider reported about the "the stocks market's robot revolution". Whereas the title was crying, a summary was more reserved: The fund has outperformed the S&P 500 so far, but a much longer trading period is needed to assess whether it can truly offer market-beating returns. I scheduled in my calendar to have a look at this fund in a year, telling a colleague, who pointed me on AIEQ that I would bet a bottle of whisky (bot not a farm!) that this ETF will perform worse than its benchmark. I turned out to be right.

Continue reading "AIEQ the AI Powered Equity ETF: Artificial Intelligence is Still Losing to a Natural Stupidity"

Continue reading "AIEQ the AI Powered Equity ETF: Artificial Intelligence is Still Losing to a Natural Stupidity"

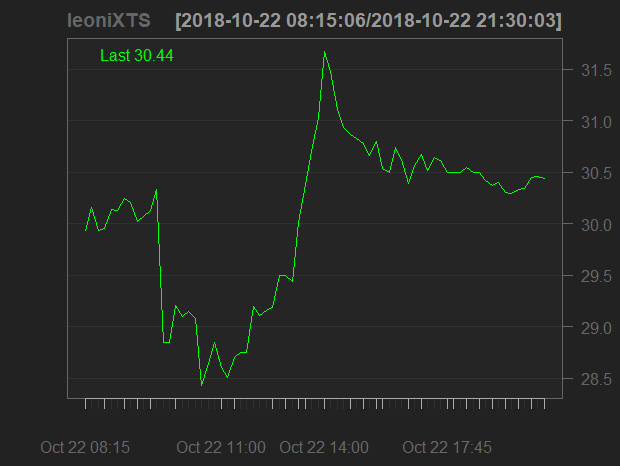

Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?

Leoni AG is a German company, specializing in production of high-quality cables for cars. Its shares are traded in sDAX (index of the best German smallcaps). From the beginning of the year Leoni's stock has lost more than 50%. Today, as Leoni has issued a profit warning, its stocks first fell about -6% but then quickly turned around to +5%, ending up by +1.5%. It may mean that the market is tired of the negative news. And even if not yet, German automotive is already fundamentally cheap. Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"

Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"