We consider 12 most popular and/or mostly discussed fully automated forex trading stratagies on myfxbook.com. This case study clearly shows that it is possible to consistently make money by forex trading. Of course it does not mean that it is easy. Continue reading "12 Consistentently Profitable Automatic FX Strategies"

Category: BestPractice

Optimal Number of Trades: better less but better

A very important question, which every trader or investor encounters is how many trades to commit or how many stocks to hold in portfolio. Whereas the law of the large numbers readily gives a [naive] answer "the more the better", in practice the answer is often better less but better. Continue reading "Optimal Number of Trades: better less but better"

Zinseszinswunder in Action: mit 200 DM/mo. in DAX seit 1959 wärst Du Millionär

Wer in DAX seit 1959 jeden Monat 200 DM bzw. €100 angelegt hätte, wäre nun Millionär. Zwar es in diesem Fall auch viel "wenn das Wörtchen wenn nicht wär" gibt, ist dieser Fall nicht unrealistisch und bestimmt betrachtenswert. Denn selbst wenn man den Zeitvorrat nicht von 60 sondern "lediglich" von 30 Jahren hat und die Rendite "nur" von 6% p.a. erreicht, wird man zumindest die Altersarmut vermeiden! Continue reading "Zinseszinswunder in Action: mit 200 DM/mo. in DAX seit 1959 wärst Du Millionär"

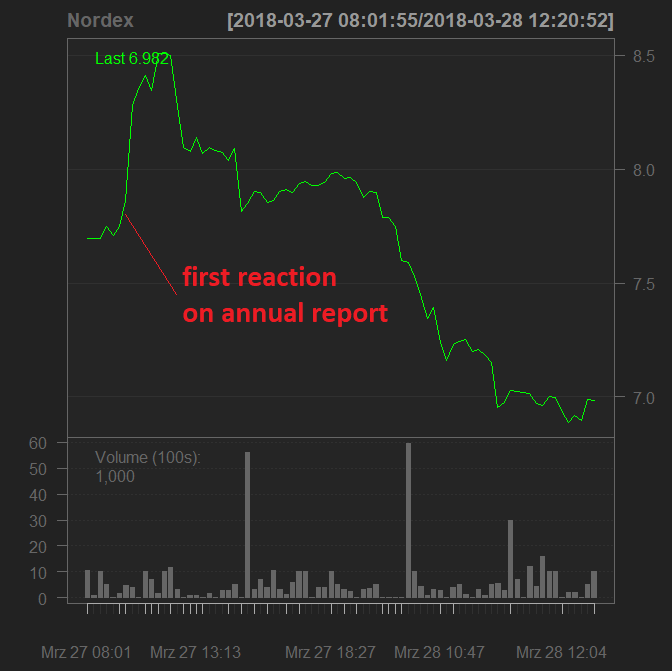

Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy

Nordex SE is one of the leading producers of the wind turbines. Its stock has a long difficult story, being both a tenbagger and a miserable loser. In either case it offers a lot of interesting case studies, one of which is the reaction to the annual report and the bankruptcy of a peer SolarWorld.

Continue reading "Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy"

Continue reading "Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy"

Does Stock Picking Still Make Sense? Yes, it does!

Many "experts", at least in Germany, state nowadays: currently the markets are driven by macroeconomic factors (FED and ECB policies, quantitative easing, etc) thus the stock picking does not make sense. We show that it still does. Continue reading "Does Stock Picking Still Make Sense? Yes, it does!"

Visualizing the Data on 6356 American Stocks – with R source code

By current artificial intelligence, big data and robo-advisory hype many people believe that computers can do everything for you. I am pretty skeptical about it. Never denying (and actively engaging by myself) a computer-aided trading and investment I always claim "man and machine" rather than "man vs. machine". In this post I show you how to summarize and visualize the data from Alpha Vantage for 6356 American stocks. Continue reading "Visualizing the Data on 6356 American Stocks – with R source code"

Patterns of Technical Analysis – Do They Work?

Seven years ago I tried to reproduce the results of "Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation" by Lo, Mamaysky and Wang with more recent data than they used. Lo et al come to the conclusion that the chart patterns are statistically significant (which does not yet mean their practical usability). My results shows that there is no statistical significance (anymore). Continue reading "Patterns of Technical Analysis – Do They Work?"

Susan Levermann Strategy – 13 rules that work on the stock market

On the 8 of March, the international Women's Day we review the strategy of Susan Levermann, a highly successful portfolio manager. Hollywood shows the Wall Street as a typically masculine domain. However, Frau Leverman has proven that a smart and persistent vixen may be more successful than an impudent and impatient wall street wolf. Continue reading "Susan Levermann Strategy – 13 rules that work on the stock market"

Rendite-Rechner für Sparplan (bzw. beliebigen Cashflow ohne Teilauszahlungen)

Bedauerlicherweise kennen nur die wenigen Privatanleger die Renditen ihrer Sparpläne. Dieser kostenlose Online Rendite-Rechner soll die Situation ändern. Im Internet gibt es jede Menge der Renditenrechner. Allergings lassen Alle nur die Einmaleinzahlung und die regelmäßigen gleichen Sparraten zu. Die Realität ist aber komplizierter, so geben wir Dir die Möglichkeit, die Rendite eines Sparplans mit beliebigen Einzahlungen zu kalkulieren. Lediglich sind die Entnahmen nicht erlaubt, da man die Rendite bzw. den Effektivzins für einen Cashflow mit Teilauszahlungen generell nicht eindeutig definieren kann. Continue reading "Rendite-Rechner für Sparplan (bzw. beliebigen Cashflow ohne Teilauszahlungen)"

JuniorDepot3a – explaining correlation and diversification to a 7 year old girl

Market fall and so does Elle's portfolio. However, we still perform better than market due to diversification. So we use the opportunity to explain a 7-year old girl the idea of correlation. Continue reading "JuniorDepot3a – explaining correlation and diversification to a 7 year old girl"