Stock tickers from M to Z. Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [M-Z]"

Category: GermanStocks

Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [G-L]

Stock tickers from G to L. Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [G-L]"

Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [D-F]

Volatility clustering plots for stocks with yahoo.finance tickers from D to F. Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [D-F]"

Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [A-C]

Volatility clustering plots for stocks with yahoo.finance tickers from A to C.

Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [A-C]"

Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [0-9]

We continue publishing the visualized results from Vasily Nekrasov's research. Reportedly, when Warren Buffett happens to hear complains that there are thousands of stocks to scrutinize, he says "well, start with letter A". We go even further and start with digit 0, since there are (were) suchlike tickers by yahoo.finance. Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part II – 2940 stocks – [0-9]"

Volatility Clustering and Piecewise Homoscedasticity – Part I – Indices

This is a well-known fact that the stock prices are virtually unpredictable. However, stock volatilities can more or less be forecasted! In 2012 Vasily Nekrasov scrutinized about 3000 asset price time series, obtained from yahoo.finance. Approximately in half of cases the volatility was piecewise-stationary and thus predicatable. We put online the technical record from 2012 and start publishing the visualized results Continue reading "Volatility Clustering and Piecewise Homoscedasticity – Part I – Indices"

Deutsche Vermögensverwaltung: unfähige institutionelle Assetmanager und selbsternannte Börsengurus

Während der Zerozinsenzeit wird immer lauter darüber gesprochen, dass man sein Geld lieber investieren als auf Tagesgeldkonto parken sollte. An sich ist es richtig, aber mit der Auswahl des Vermögensverwalters muss man sehr vorsichtig sein. Der bekehrte Schwabe empfielt: schauen Sie selbst die Performance an, anstatt die Werbung blind zu vertrauen. Erinnern Sie sich immer daran, dass die kostenlosen "Beratungsgespräche" fast immer Verkaufsgespreche sind! Eine Alternative dazu ist die Honorarberatung, jedoch ist ein Honorarberater ohne Track Record nichts Wert! Passive Anlage ist generell keine schlechte Idee, aber selbst der Aufbau eines gut diversifizieren Portfolios ist auch keine triviale Aufgabe.

Während der Zerozinsenzeit wird immer lauter darüber gesprochen, dass man sein Geld lieber investieren als auf Tagesgeldkonto parken sollte. An sich ist es richtig, aber mit der Auswahl des Vermögensverwalters muss man sehr vorsichtig sein. Der bekehrte Schwabe empfielt: schauen Sie selbst die Performance an, anstatt die Werbung blind zu vertrauen. Erinnern Sie sich immer daran, dass die kostenlosen "Beratungsgespräche" fast immer Verkaufsgespreche sind! Eine Alternative dazu ist die Honorarberatung, jedoch ist ein Honorarberater ohne Track Record nichts Wert! Passive Anlage ist generell keine schlechte Idee, aber selbst der Aufbau eines gut diversifizieren Portfolios ist auch keine triviale Aufgabe.

Trump trade: case study of DAX intraday on 09.11.2016

Donald Trump's victory on 09.11.2016 was likely as surprising for markets as Brexit was. However, the expected (and factual) aftermath was completely different. This case is good to learn when you should urgently sell and when not Continue reading "Trump trade: case study of DAX intraday on 09.11.2016"

Continue reading "Trump trade: case study of DAX intraday on 09.11.2016"

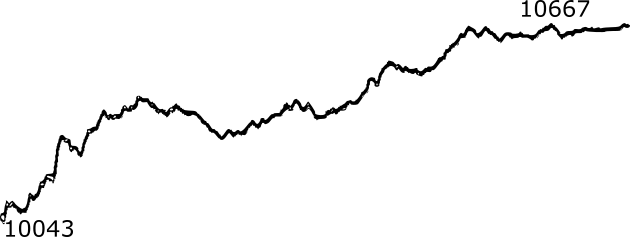

My Fund Somewhat better than DUCKS is 1 year old: a festive but fair review

My wikifolio ("Somewhat better than DUCKS", ISIN: DE000LS9HDK3) is investable from 28.10.2016. It surely beats the DAX (main German stock index) both on absolute and risk-adjusted performance. Though I am very proud of my performance, I provide a closer look at it and show that sometimes I had just luck and sometimes I could have done better. I always preach for the rigorous and cold-blooded performance analysis and the best sermon is to demonstrate it by the example of myself.

Continue reading "My Fund Somewhat better than DUCKS is 1 year old: a festive but fair review"

Update (12.10.2016) to K+S, Lufthansa, Osram and WTI

Recently I wrote about K+S and Lufthansa, Osram and WTI Oil.

Let us review this opportunities:

1) K+S: as I expected, it grows. I reduced (with small profit) my position to 2% of portfolio and (so far) will be keeping it.

2) Lufthansa: I emphasized that though I, myself, bought a little bit, I don't recommend others to do it because the LHA stock is dubious. Further the stock fell about -8% and I sold it by stop-loss. Currenly it grew about 9% from its local minimum and I recommend to sell: Lufthansa might soon "fly out" of DAX.

3) Osram: as I expected, it falls. I watch it but IMO it is still prematurely to buy.

4) WTI Oil: as Putin announced that Russia supports OPEC, oil prices jumped 3% on 10.10.2016. I halved my position with a small loss. Currently oil gradually falls again and I keep the rest of my position. However, the risks are high.