Currently the stocks are expensive and the commodities are cheap (though not all of them). We conduct a lite analysis of investment opportunities and construct a mid-term commodity portfolio for a retail investor with €10000+ capital. Continue reading "Market Spotlight: Pick up Commodities but be picky"

Category: Opportunity

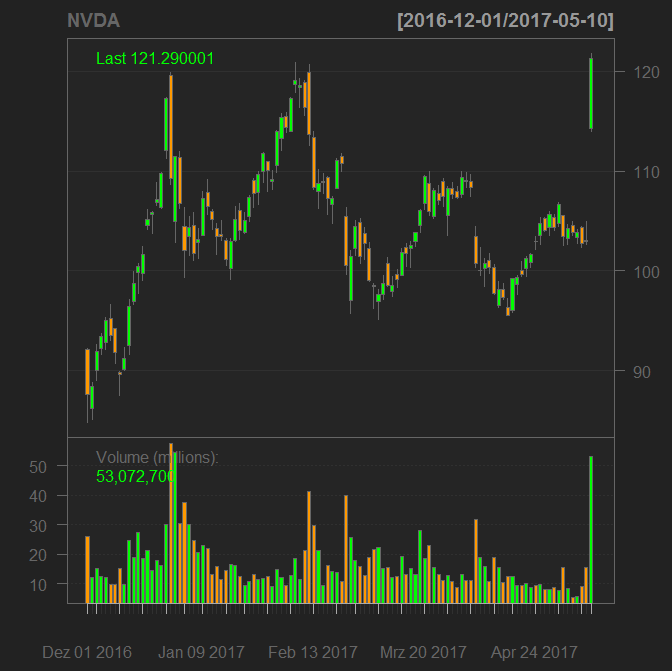

PUT on nVIDIA turned out to be far from perfect trade, but…

On 25.12.2016 I bought a put on nVIDIA since I found the stock extremely overpriced. I called it "nearly perfect trading decision", inter alia, because the implied volatility was though plausible but still high. Yesterday after the publication of Q1 financial report the stock jumped 18%. My put option is about 50% down since purchase time. But due to a strict money management I have capital for the 2nd and even fors 3rd attempt and I still consider nVIDIA as heavily overpriced.

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Finanzmesse 2017 in Stuttgart – kurzer Bericht

Wir haben Finanz 2017 Messe in Stuttgart besucht. Begrüßt wurden die Besucher von einem Teufel, und das ist sehr symbolisch: erstens „Lasst, die ihr tradet, alle Hoffnung fahren“ und zweitens, passt teuflisch darauf, was Euch angeboten bzw. angedreht wird. Allgemeiner Eindruck ist aber positiv: es gab zwar [wie immer] viel Müll aber auch gab es mehrere Innovative und Interessante Angebote.

Continue reading "Finanzmesse 2017 in Stuttgart – kurzer Bericht"

Continue reading "Finanzmesse 2017 in Stuttgart – kurzer Bericht"

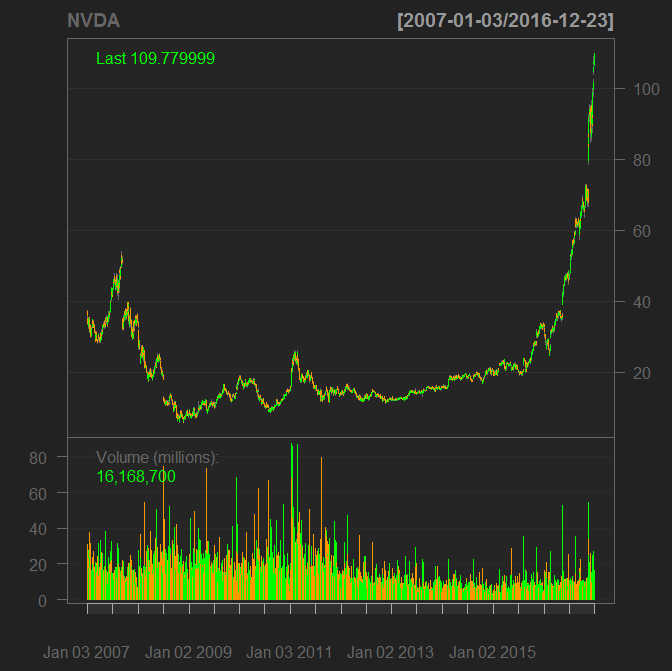

My PUT Option on NVIDIA – a case study of nearly perfect trading decision

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

NVIDIA stock (NVDA, US67066G1040) has recently exploded. Though the profits also significantly grew, the stock bubble is definitely overproportional to fundamentals. Most likely this is due the deep learning hype. So I bought a put option on NVIDIA and even if it expires worthless, I still consider it as a nearly perfect trade and explain why.

Continue reading "My PUT Option on NVIDIA – a case study of nearly perfect trading decision"

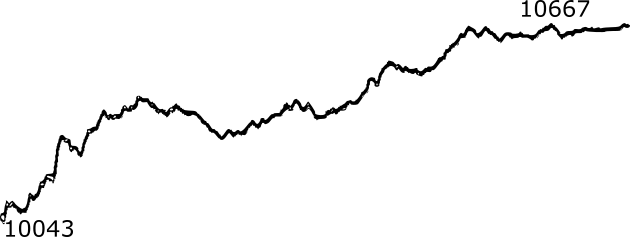

Trump trade: case study of DAX intraday on 09.11.2016

Donald Trump's victory on 09.11.2016 was likely as surprising for markets as Brexit was. However, the expected (and factual) aftermath was completely different. This case is good to learn when you should urgently sell and when not Continue reading "Trump trade: case study of DAX intraday on 09.11.2016"

Continue reading "Trump trade: case study of DAX intraday on 09.11.2016"

Oil WTI short: why it will likely fall (29.09.2016)

OPEC agrees on oil cut at Algiers meeting ... oil price jumped more than 6% ... a good opportunity to short WTI!

- OPEC members may agree on whatever they want but it is unclear how they will control the agreement and penalize violators.

- As soon as price grows the production of shale oil in USA will be increased.

- The current Brent price is $49.13 and WTI costs $47.69. Respectively, the spread is $1.44, which is pretty narrow (normally it is about $2) so it will likely widen, thus it is better to short WTI, not Brent.

Yes, there we times as the spread was tighter and even negative, but by those times both WTI and Brent tended to fall.

Update 04.10.2016

So far the oil price keeps growing though I was right with shorting WTI, not Brent, since the latter grew more intensively; the spread is now normal, about $2.

Today it was a price dip, so I halved my position with a minimal loss and keep about 1.5% of my trading capital in WTI short.

Two opportunities on German stock market: K+S und Lufthansa (27.09.2016)

K+S, a German producer of кalium salt, has reached its historical minimum, falling intraday below €16. .

Continue reading "Two opportunities on German stock market: K+S und Lufthansa (27.09.2016)"