By Elle's portfolio we implicitly target the CAGR of 6%. Alas, this year the CAGR turned out to be -24.7%! Especially our recent portfolio restructuring (sell Silver and buy DAX and WTI Oil) was not good.

Still we are better than a passive savings plan in DAX (this would have a CAGR of -30.7%) and look optimistically in future. Especially pleasant was Elle's reaction on the (temporary) drawdown: calm and stoic. This a necessarily trait for a growing Warren Buffet. Continue reading "JuniorDepot12 – DAX, Silver, Oil: pessimistic end of year and optimistic sentiment for future"

Tag: silver

JuniorDepot9 – Buying Silver ETC again

Elle, a 7-year old girl, confronted a hard choice this time: both German stocks and precious metals were relatively cheap. Finally, she decided to increase the position in silver, although before she has already bought a silver ETC a little bit prematurely. Continue reading "JuniorDepot9 – Buying Silver ETC again"

JuniorDepot8 – Buying Silver ETC and DAX ETF

Elle, a 7-year old girl, continues to grow her wealth. Recently she has bought a silver ETC and a DAX ETF (the former a little bit prematurely, the latter pretty optimally). Continue reading "JuniorDepot8 – Buying Silver ETC and DAX ETF"

JuniorDepot7a – Selling Silver and Buying DAX ETF

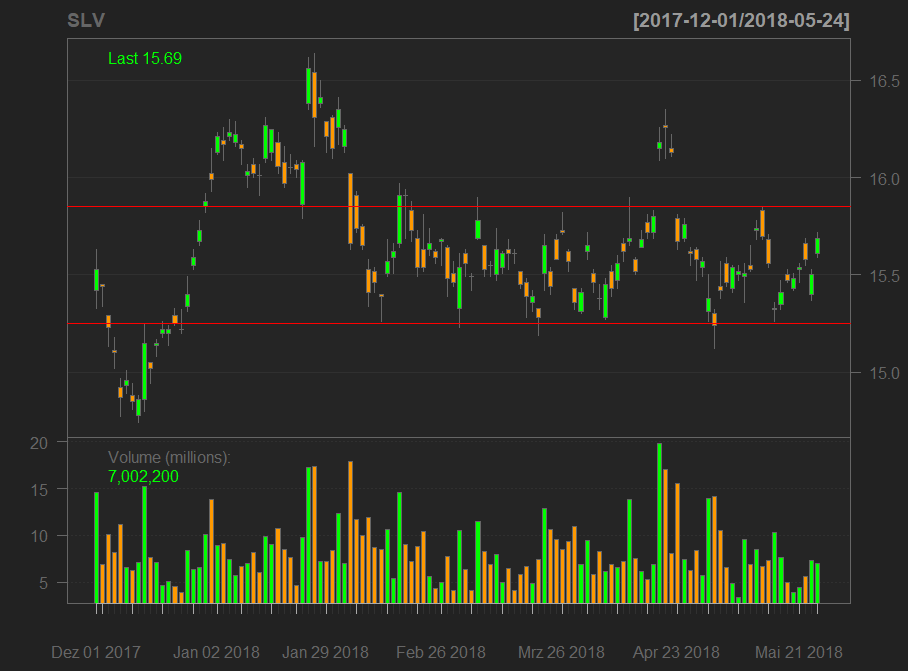

According to our plan, we sold a silver ETC near the upper line of a clearly visible channel. Today we used the DAX correction to re-buy an ETF on it. Continue reading "JuniorDepot7a – Selling Silver and Buying DAX ETF"

JuniorDepot7 – Buying Silver

The current direction of the stock market remains vague, additionally we remember sell in May and go away. Thus Elle bought silver this time, which also improved the diversification of her portfolio.

Continue reading "JuniorDepot7 – Buying Silver"

Continue reading "JuniorDepot7 – Buying Silver"

JuniorDepot5 – Learning Pain of Loss with GoPro Action

Elle, a 7-year old girl, insisted last month on investing in GoPro. Now she has to learn the pain of losing money.

Continue reading "JuniorDepot5 – Learning Pain of Loss with GoPro Action"

Continue reading "JuniorDepot5 – Learning Pain of Loss with GoPro Action"

JuniorDepot3a – explaining correlation and diversification to a 7 year old girl

Market fall and so does Elle's portfolio. However, we still perform better than market due to diversification. So we use the opportunity to explain a 7-year old girl the idea of correlation. Continue reading "JuniorDepot3a – explaining correlation and diversification to a 7 year old girl"

JuniorDepot 2 – Elle makes her first Investment in Silver

As we have recently reported, one of our readers has set up a savings plan (€100/mo.) for his 7 years old daughter Elle. We loved the idea and suggested him to let the girl decide herself,

which stocks and ETFs to buy; letYourMoneyGrow.com team assists in risk management and portfolio optimization. Our ambitious goal is to grow a new (female) Warren Buffett. Meanwhile, Elle made her first investment decision! Continue reading "JuniorDepot 2 – Elle makes her first Investment in Silver"

Market Spotlight: Pick up Commodities but be picky

Currently the stocks are expensive and the commodities are cheap (though not all of them). We conduct a lite analysis of investment opportunities and construct a mid-term commodity portfolio for a retail investor with €10000+ capital. Continue reading "Market Spotlight: Pick up Commodities but be picky"