Since I got asked over and over again how to become a quant, I decided to publish a small essay, going through a letter of my blog reader. I myself managed to change to mathematical finance and risk management from pure software development. I like what I am doing but quant jobs are not as sexy as many young professionals believe. Continue reading "Wanna be Quant? Probably not anymore after reading this"

Author: letYourMoneyGrow.com

12 Consistentently Profitable Automatic FX Strategies

We consider 12 most popular and/or mostly discussed fully automated forex trading stratagies on myfxbook.com. This case study clearly shows that it is possible to consistently make money by forex trading. Of course it does not mean that it is easy. Continue reading "12 Consistentently Profitable Automatic FX Strategies"

Optimal Number of Trades: better less but better

A very important question, which every trader or investor encounters is how many trades to commit or how many stocks to hold in portfolio. Whereas the law of the large numbers readily gives a [naive] answer "the more the better", in practice the answer is often better less but better. Continue reading "Optimal Number of Trades: better less but better"

JuniorDepot6 – Buying German Mid-Cap ETF and Getting Breakeven

Elle, a 7-year old girl who manages her savings plan with letYourMoneyGrow.com, became more careful after her stockpicking flop with GoPro and readily agrees to invest in an index ETF so far. We explain why we bought an ETF on mDAX this time and review our quarterly performance. Continue reading "JuniorDepot6 – Buying German Mid-Cap ETF and Getting Breakeven"

DeGiro hat die Liste der kostenfreien ETFs aktualisiert – Stand 31.03.2018

DeGiro ist der günstigste Broker in Deutschland, der nicht nur die kleinsten Gebühren hat, sondern auch bietet viele ETFs quasi kostenlos an. Leider sind viele davon wegen PRIIPs für EU-Privatinvestoren unzugänglich geworden. DeGiro hat die Liste aktualisiert. Zwar sind von 700 nur 200 geworden, ist es nach wie vor für Privatanleger mehr als genug.

Continue reading "DeGiro hat die Liste der kostenfreien ETFs aktualisiert – Stand 31.03.2018"

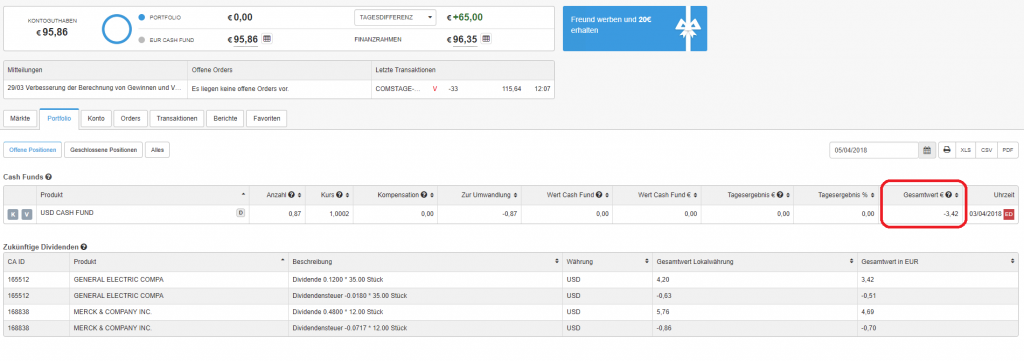

DeGiro spinnt mit Cash Funds und Handelsmodalitäten

DeGiro war und ist wohl der günstigste Broker für Deutsche Anleger. Jedoch wenn es zu Nuancen kommt, kann der Kunde unangenehm überrascht werden. Wir nehmen die Handelsmodalitäten und vor kurzem eingeführte Cashfunds unter der Lupe.

Continue reading "DeGiro spinnt mit Cash Funds und Handelsmodalitäten"

Continue reading "DeGiro spinnt mit Cash Funds und Handelsmodalitäten"

Prophetische Misere von Schmercedes: Daimler Aktie fällt

Heute fiel die Aktie von Daimler um mehr als 6%. Grund dafür war wohl der Dividendenabschlag aber vor allem die Enttäuschung der Aktionäre mit der Rede vom Dr. Z.

Dummerweise habe ich die Daimler als Beispiel genommen, als ich in meinem vor kurzem veröffentlichen Buch die Leser vor blinden Investitionen in "günstigen" Unternehmen warnte. Das war prophetisch und es lohnt sich diesen Fall genauer zu betrachten.

Continue reading "Prophetische Misere von Schmercedes: Daimler Aktie fällt"

Continue reading "Prophetische Misere von Schmercedes: Daimler Aktie fällt"

A Quick but Insightful Look at Stock Fundamental Data Summary

StockPup.com generously shares the fundamental data for several hundred stocks. However, there are a lot of outliers and missing data. We present some interesting results for the market summary and the long-term trends.

Continue reading "A Quick but Insightful Look at Stock Fundamental Data Summary"

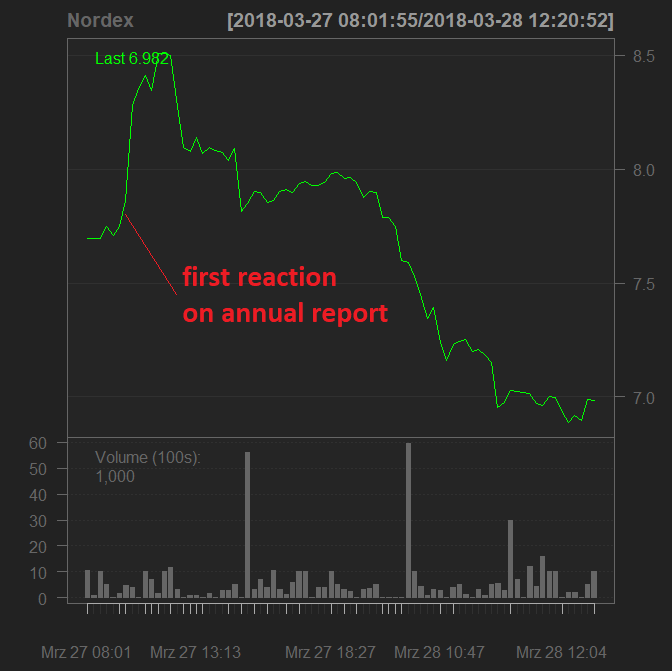

Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy

Nordex SE is one of the leading producers of the wind turbines. Its stock has a long difficult story, being both a tenbagger and a miserable loser. In either case it offers a lot of interesting case studies, one of which is the reaction to the annual report and the bankruptcy of a peer SolarWorld.

Continue reading "Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy"

Continue reading "Nordex – Market Reaction to Annual Report and SolarWorld Bankruptcy"

Does Stock Picking Still Make Sense? Yes, it does!

Many "experts", at least in Germany, state nowadays: currently the markets are driven by macroeconomic factors (FED and ECB policies, quantitative easing, etc) thus the stock picking does not make sense. We show that it still does. Continue reading "Does Stock Picking Still Make Sense? Yes, it does!"