Since DeGiro announced closure of Elle's depot on May 15, 2022 she had to optimally close her positions before this date. Unfortunately, the announcement of depot termination coincided with market correction and further macroeconomic risks due to Russian invasion of Ukraine.

Thus the achieved CAGR is just 2.06%, not 6% as pursued. Still it is much better than a bank deposit with zero (or even negative) rate and given the permanent deterioration of DeGiro the result is not that bad. Continue reading "JuniorDepot31 – Experiment Termination"

Category: JuniorDepot

JuniorDepot30 – The Final Degradation of DeGiro

On 10.02.2022 DeGiro notified Elle that her Depot is going to be closed due to inability to run a bank account for an underage person.

This is a very illustrative case of the operational risk.

Continue reading "JuniorDepot30 – The Final Degradation of DeGiro"

JuniorDepot29 – (Over)archieving the Financial Plan (thanks to AI and NI)

Since we did not report about Elle's progress for more than a year, the readers of letYourMoneyGrow.com might have thought that we have terminated our experiment of growing a 7 (currently 11) years young girl as an investor. Nope, not at all! As a matter of fact we worked hard on creation and test of a deep neural network for the stock (pre)selection. And it did work, our CAGR goal is (over)achieved!

Continue reading "JuniorDepot29 – (Over)archieving the Financial Plan (thanks to AI and NI)"

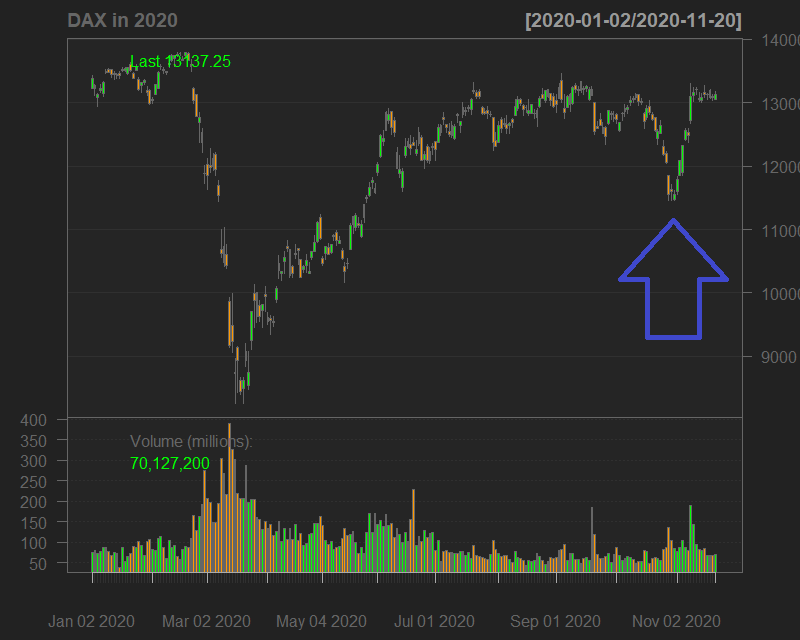

JuniorDepot28 – Catching-Up the Target CAGR and Beating the DAX

DAX, the German main stock index, fell on the 2nd lockdown in October but quickly recovered in November 2020. Elle made use of this movement, both achieving her target rate of return and beating the DAX. Continue reading "JuniorDepot28 – Catching-Up the Target CAGR and Beating the DAX"

Continue reading "JuniorDepot28 – Catching-Up the Target CAGR and Beating the DAX"

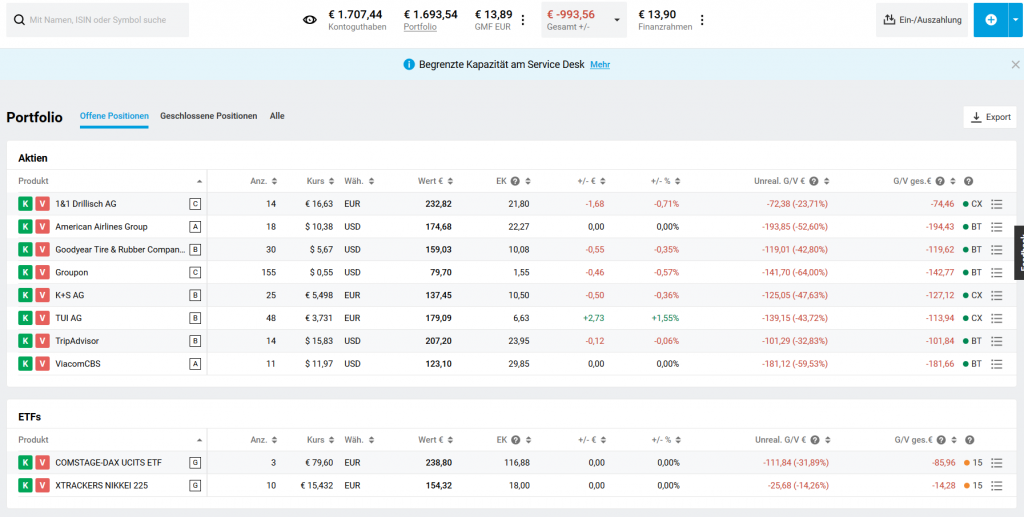

JuniorDepot27 – Profitable but Still Worse than DAX, so far…

Last weeks Elle was inactive, patiently waiting for an opportunity to buy cheaply. It came with a "common" September correction. Still Elle stays very cautious because this time the October (the most volatile month on average) will definitely be extremely volatile due to President elections in USA. Continue reading "JuniorDepot27 – Profitable but Still Worse than DAX, so far…"

JuniorDepot26 – A Calm Before the Storm

Elle's portfolio stagnates, slipping slightly to loss due to the USD weakness. We were risk averse and missed the (exuberant) growth of the last month. However, after the publication of macroeconomic data the market seems to start oping its eyes. Continue reading "JuniorDepot26 – A Calm Before the Storm"

JuniorDepot25 – Profitable Again

Elle's depot turned back to profitability thanks to recent exuberant market growth. We closed most of our positions and await a drop after a pretty groundless euphoria. Continue reading "JuniorDepot25 – Profitable Again"

JuniorDepot24 – A Gradual Recovery

Elle's timing during the Corona-Crisis was premature and lead to a significant drawdown. However, her depot recovers gradually. We accumulate cash, awaiting the 2nd wave of COVID-19. Continue reading "JuniorDepot24 – A Gradual Recovery"

JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism

Unfortunately we (i.e. I) have misestimated the Corona-Virus impact. Elle's portfolio experiences a severe drawdown. Still we are happy that it happened in the beginning (rather than in the end) of our savings plan.

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

Continue reading "JuniorDepot23 – COVID Crash impacts Elle’s Portfolio but not her Optimism"

JuniorDepot22 – Portfolio Down (a bit) but Mood Up

Having lost the option to invest in ETCs and inverse ETFs, Elle is forced to concentrate on the stockpicking. So far, the result is (a bit) negative but we are quite optimistic for the long run. Continue reading "JuniorDepot22 – Portfolio Down (a bit) but Mood Up"