Malkiel affirms that the stock returns follow the random walk. Lo and MacKinlay retort they do not.

In this post I show how a mean-reverting process can be efficiently disguised as a random walk. Most likely, the market does follow a similar disguise-pattern (at least sometimes). Continue reading "Reproducing a Pseudo-Random Walk down the Wall Street"

Category: numeracyForTraders

A Fairy Tail or The Magic of Extreme Casino Wins

Michael Shackleford, a who has made a career of analyzing casino games, designed Australian Reels Slot Machine in 2009. In modeling the casino's risk of ruin he (blindly) relied on the normal distribution. We show that this drastically undervalues the tail risk. Continue reading "A Fairy Tail or The Magic of Extreme Casino Wins"

JuniorDepot7c – Lots of Actions and Calculations

Market were really turbulent during the last weeks. We committed a lot of trades with Elle and did some important calculations of our trading costs. Continue reading "JuniorDepot7c – Lots of Actions and Calculations"

Optimal Number of Trades: better less but better

A very important question, which every trader or investor encounters is how many trades to commit or how many stocks to hold in portfolio. Whereas the law of the large numbers readily gives a [naive] answer "the more the better", in practice the answer is often better less but better. Continue reading "Optimal Number of Trades: better less but better"

JuniorDepot3a – explaining correlation and diversification to a 7 year old girl

Market fall and so does Elle's portfolio. However, we still perform better than market due to diversification. So we use the opportunity to explain a 7-year old girl the idea of correlation. Continue reading "JuniorDepot3a – explaining correlation and diversification to a 7 year old girl"

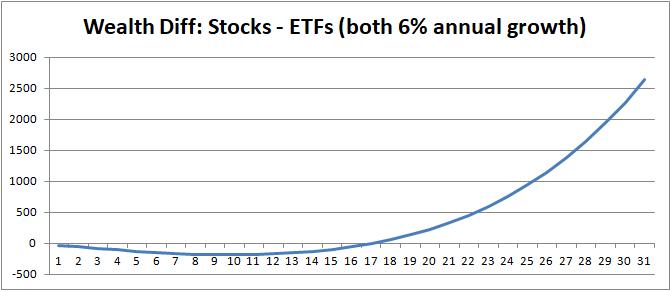

ETFs don’t save (and indeed increase) costs in long term

Apologists of the passive investment claim: stock ETFs save the costs. Indeed they saved costs as broker fees were high. But now they don't, in fact they increase them! Of course sometimes there is no alternative to an ETF/ETC/ETN, e.g. if you want to invest in commodity market. But if you can buy stocks with low broker fees, you should do it directly.

ETF Apologeten behapten: die Aktien-ETF sparen Kosten. Tatsache ist: die sparten die Kosten, als Brokergebühren noch hoch waren. Aktuell ist es nicht mehr der Fall, langfristig sind die Kosten bei den Aktien-ETF sogar höher als beim Direktkauf. Continue reading "ETFs don’t save (and indeed increase) costs in long term"

Continue reading "ETFs don’t save (and indeed increase) costs in long term"

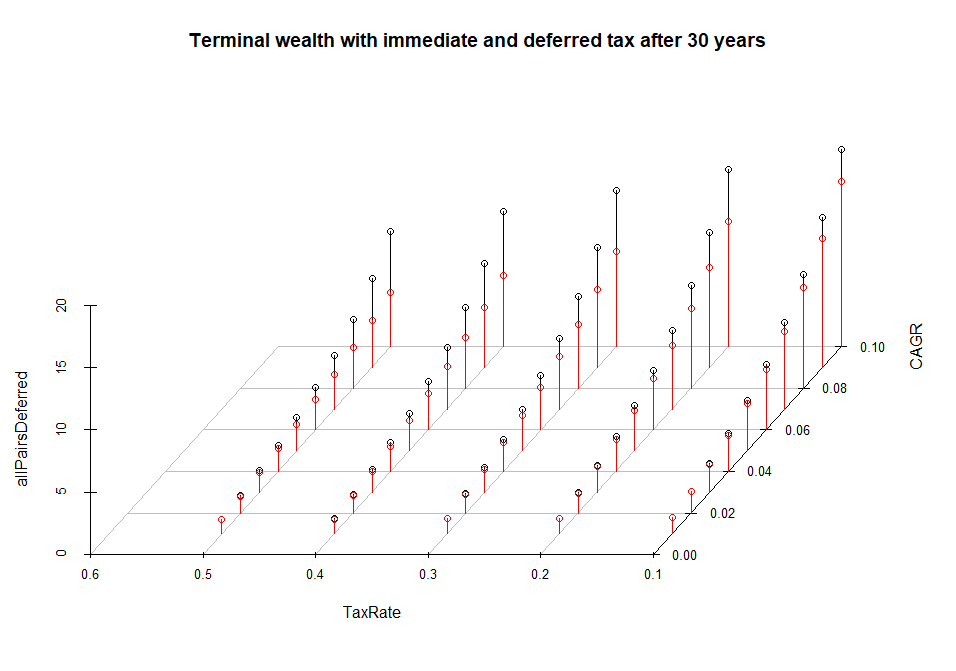

Numeracy for Traders – Lesson 3 – Ode to Deferred Withholding Tax

Many investment funds and financial services that want your money argue with a deferred capital yield tax. For instance, in Germany if you trade by yourself, you immediately pay the capital returns tax [Kapitalertragsteuer] (unless the net result of your previous trades is negative). But if you invest in a fund, you don't pay the tax on returns until you sell your share (you still pay a tax on dividends).

We show that though, in general, an investor profits from tax deferral, one should not exaggerate its effect. Moreover, due to annual tax-exempt amounts [Jahresfreibetrag], an immediate taxation can be better than a deferred one.

Continue reading "Numeracy for Traders – Lesson 3 – Ode to Deferred Withholding Tax"

Continue reading "Numeracy for Traders – Lesson 3 – Ode to Deferred Withholding Tax"

Perfect diversification means no asset can be dropped from (rather than added to) a portfolio

A common belief: adding extra asset to a portfolio will automatically reduce the portfolio risk. We provide a counter-example resorting only to the simplest algebra and explain why this erroneous belief is so common.

Numeracy for Traders – Lesson 2 – Exponentiation, polynomials, logarithms and the power of compound returns

After this lesson you will understand how to compute the compound return, discount factors and the CAGR (compound annual growth rate: nominal and inflation adjusted). You will also learn about the continuously compounded (exponential) interest and logarithmic returns. Finally, you will be able to calculate the effective rate of interest of a credit or of a savings scheme.

After this lesson you will understand how to compute the compound return, discount factors and the CAGR (compound annual growth rate: nominal and inflation adjusted). You will also learn about the continuously compounded (exponential) interest and logarithmic returns. Finally, you will be able to calculate the effective rate of interest of a credit or of a savings scheme.