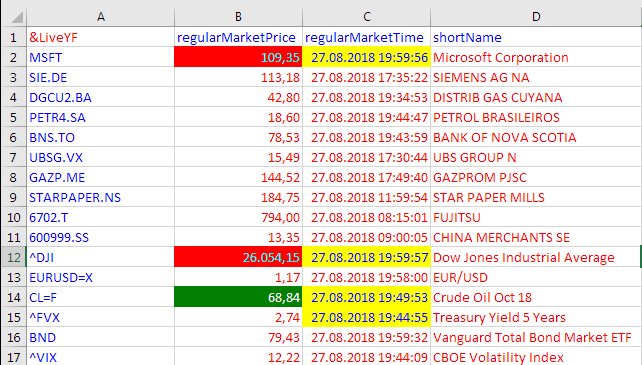

Leoni AG is a German company, specializing in production of high-quality cables for cars. Its shares are traded in sDAX (index of the best German smallcaps). From the beginning of the year Leoni's stock has lost more than 50%. Today, as Leoni has issued a profit warning, its stocks first fell about -6% but then quickly turned around to +5%, ending up by +1.5%. It may mean that the market is tired of the negative news. And even if not yet, German automotive is already fundamentally cheap. Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"

Continue reading "Intraday Somersault of Leoni AG stock: A General Turnaround in German Automotive?"

JuniorDepot10 – Speculating Gold and Getting Benefits of Diversification

This time Elle, a 7-year old girl, first bought a physical gold ETC but then quickly sold it and bought an ETF on DAX. Concretely this trade was a bit premature but the portfolio diversification (in particular by means of precious metals) still brought benefits. Continue reading "JuniorDepot10 – Speculating Gold and Getting Benefits of Diversification"

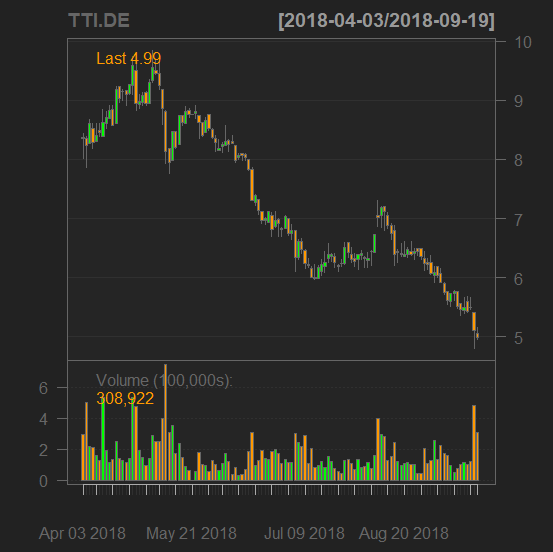

Tom and Gerry 3: a dead mouse bounce?

Whereas Tom Tailor continues to decline, Gerry Weber has recently bounced +40% as the founder Gerhard Weber resigned from CEO position. Yet we bought Tom Tailor stock, although we usually do not trade against a strong trend. We explain why it was plausible to make an exception this time. Continue reading "Tom and Gerry 3: a dead mouse bounce?"

The Highest Volatility in October? Don’t trust a Superficial Statistics!

A recent post "Fasten your seat belt for stocks: October is almost here" on MarketWatch, repeated by Morningstar and shared in my social networks may make an illusion that it is likely to expect high(est) volatility in October. A little bit more detailed statistical analysis shows that such expectation is superficial.

A more general (and very old) lesson from this case: the statistical analysis is much more than a primitive consideration of the mean values in groups. And of course: don't trust provoking titles.  Continue reading "The Highest Volatility in October? Don’t trust a Superficial Statistics!"

Continue reading "The Highest Volatility in October? Don’t trust a Superficial Statistics!"

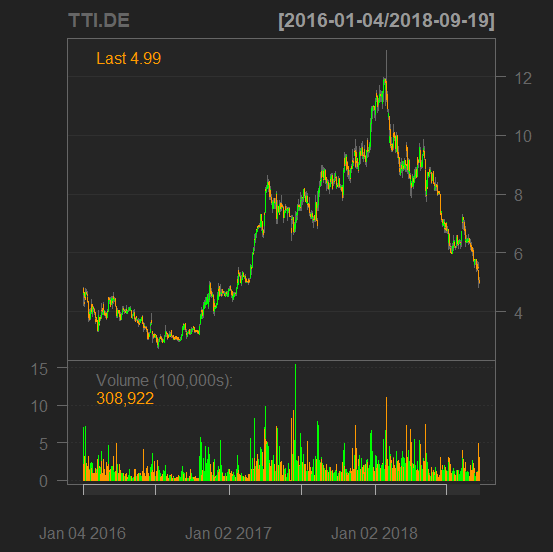

Tom and Gerry 2 – a perfect case study for peer trading

Tom [Tailor] and Gerry [Weber] are two German fashion boutiques (both are small caps). On January 7, 2016 I wrote a post "Tom And Gerry - Turnaround By Two German Fashion SmallCaps". In this post I correctly predicted the growth of Gerry Weber, based on the previous growth of Tom Tailor. Now one could have predicted the fall of Tom Tailor based on the previous fall of Gerry Weber. A perfect pair for peer trading isn' it?!

|

|

Continue reading "Tom and Gerry 2 – a perfect case study for peer trading"

letYourMoneyGrow.com Serves You on Ubuntu 18.04.1 LTS Linux

We have successfully migrated from Ubuntu 16 to Ubuntu 18, assuring stable and secure functioning of letYourMoneyGrow.com for the next several years. We had to disable social login but the users that registered with their social network accounts can use our services as before (they merely need to reset their passwords). Continue reading "letYourMoneyGrow.com Serves You on Ubuntu 18.04.1 LTS Linux"

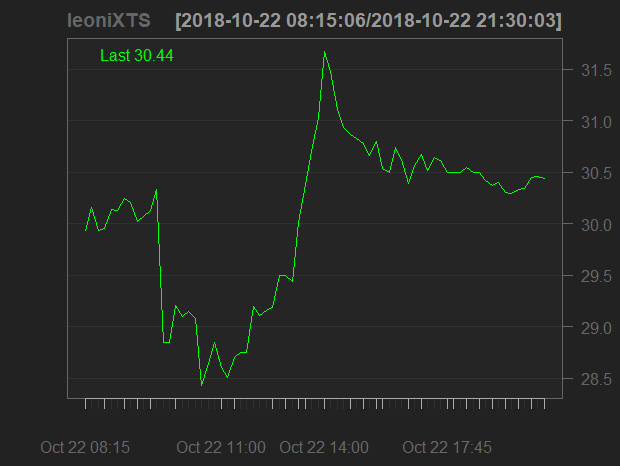

Yahoo Finance Live Feeds in Excel after their API Discontinuation in November 2017

On the fateful Wednesday of November 1st, 2017 Yahoo decided to stop their – until then – free service of delivering real time market data as a text stream through a special URL. For hundreds of businesses and individuals who had relied for years on Yahoo's benevolent free service, this single action meant only one thing: Instant death! Continue reading "Yahoo Finance Live Feeds in Excel after their API Discontinuation in November 2017"

JuniorDepot9 – Buying Silver ETC again

Elle, a 7-year old girl, confronted a hard choice this time: both German stocks and precious metals were relatively cheap. Finally, she decided to increase the position in silver, although before she has already bought a silver ETC a little bit prematurely. Continue reading "JuniorDepot9 – Buying Silver ETC again"

Your Fundamental Analysis is Only as Good as Your Data are: The Example of NWL

Whereas the opinions on the usefulness of technical analysis are highly controversial, it is generally agreed that the fundamental analysis does make sense. Value investing, e.g. the choice of companies with low p/e and p/b coefficients but high RoE and EBIT-Margin is not an uncommon approach. However, the data quality and creative data interpretation are critical. Otherwise one yields yet another GiGo: Garbage in, Garbage out! Continue reading "Your Fundamental Analysis is Only as Good as Your Data are: The Example of NWL"

What You Have Missed by Not Buying Our Stocklist for just $5 – Part II: Statistical significance

Two months ago we suggested you to buy a list of stocks, carefully selected from SP500 index on both fundamental and technical criteria. One month later we have published the results: though our stocklist has clearly beaten SPY there were no evidences of formal statistical significance. Now there are. Moreover, you have an opportunity to buy our next stockpicking report just for $10. Continue reading "What You Have Missed by Not Buying Our Stocklist for just $5 – Part II: Statistical significance"