Elle, a 7-year old girl, continues to grow her wealth. Recently she has bought a silver ETC and a DAX ETF (the former a little bit prematurely, the latter pretty optimally). Continue reading "JuniorDepot8 – Buying Silver ETC and DAX ETF"

Tag: asset allocation

JuniorDepot7c – Lots of Actions and Calculations

Market were really turbulent during the last weeks. We committed a lot of trades with Elle and did some important calculations of our trading costs. Continue reading "JuniorDepot7c – Lots of Actions and Calculations"

The Fairest Reward System for a Wealth Manager

In this essay I try to figure out the most fair reward system for a wealth manager. I don't appeal to the notorious utility functions or mathematical optimization models that fail in practice due to the errors of parameter estimation. Rather I rely on best practices and common sense. Continue reading "The Fairest Reward System for a Wealth Manager"

Portfolio Simulator – estimate the expected risk and return of your investments

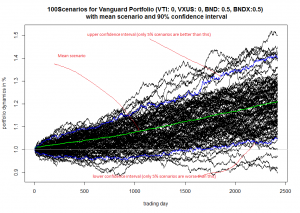

Our simulator allows you to simulate 100 future scenarios of your portfolios, estimate the expected risk, return and correlations, helping you to improve the diversification of your portfolios. The simulator projects the historical returns in future and is completely model-free (in particular, we don't make an unrealistic assumption of Normally-distributed returns). Though the past doesn't capture all possible future scenarios, it provides a good idea of possible outcomes.

Continue reading "Portfolio Simulator – estimate the expected risk and return of your investments"

A simple scenario simulator for Vanguard optimal portfolio

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

Continue reading "A simple scenario simulator for Vanguard optimal portfolio"

Einstein – a star trader on Wikifolio, who can beat the market

Summary: In our previous post we reviewed Wikifolio.com, a FinTech project that lets everybody build a proven track record. Today we review the performance of Einstein's portfolio "Platintrader 1000% Leidenschaft" and explain why his performance is a matter of trading mastership, not of just luck.

Continue reading "Einstein – a star trader on Wikifolio, who can beat the market"

The power of diversification and its limits by the example of DAX

Summary

- Sometimes (esp. to fool inexperienced retail investors) the diversification is claimed to be a silver bullet (even in a financial crisis). I show that in crises the diversification effect weakens significantly but still persists (esp. for "defensive" stocks).

- I argue that in a normal (non-turbulent) market the diversification is very helpful in theory but also critically consider its applicability in practice.

- The results that we obtained for the DAX / German stock market should be extrapolated with caution for other markets. You will also see why it is better to watch and know the market (rather than to blindly rely on quantitative analysis and common sense).

Continue reading "The power of diversification and its limits by the example of DAX"

Stripping down the robo-advisors: sparrow-brains inside

Summary:

- Robo-advisors promise the risk profiling in a few easy steps, which is unrealistic both from mathematical and behavioral points of view.

- The "optimal" portfolios are usually based on Markowitz-like models, which are inapplicable in practice due to their extreme numerical sensitivity to the market parameters estimation errors.

- Robo-advisors lure investors with low management fees but minimizing fees and maximizing the wealth is not the same. Moreover, the compound costs are not so small in the long term.

- A positive side: Robo-advisers do not (yet) foist toxic financial products upon you.

Continue reading "Stripping down the robo-advisors: sparrow-brains inside"