The maximum drawdown (MDD) is likely the most important measure of risk in practice. We explain how to calculate it and why you should keep it under control. Remember, if the MMD reaches -50% the portfolio have to grow +100% in order just to compensate the previous loss!

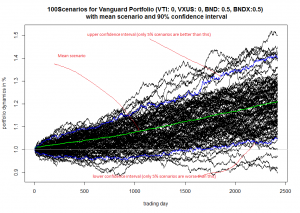

A simple scenario simulator for Vanguard optimal portfolio

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

There is yet another Roboadvisor from Vanguard Group. As any RoboAdvisor, its recommendations are far from perfection. However, I like it (at least more than others) because the Vanguard guys managed to make it simple. On the other hand I am quite disappointed that they do not show how a suggested portfolio may evolve (and I am quite sure that legendary John Bogle would be disappointed too). That's why I made a simple scenario simulator on my own. It is based on sample with replacement.

Continue reading "A simple scenario simulator for Vanguard optimal portfolio"

Update (12.10.2016) to K+S, Lufthansa, Osram and WTI

Recently I wrote about K+S and Lufthansa, Osram and WTI Oil.

Let us review this opportunities:

1) K+S: as I expected, it grows. I reduced (with small profit) my position to 2% of portfolio and (so far) will be keeping it.

2) Lufthansa: I emphasized that though I, myself, bought a little bit, I don't recommend others to do it because the LHA stock is dubious. Further the stock fell about -8% and I sold it by stop-loss. Currenly it grew about 9% from its local minimum and I recommend to sell: Lufthansa might soon "fly out" of DAX.

3) Osram: as I expected, it falls. I watch it but IMO it is still prematurely to buy.

4) WTI Oil: as Putin announced that Russia supports OPEC, oil prices jumped 3% on 10.10.2016. I halved my position with a small loss. Currently oil gradually falls again and I keep the rest of my position. However, the risks are high.

Einstein – a star trader on Wikifolio, who can beat the market

Summary: In our previous post we reviewed Wikifolio.com, a FinTech project that lets everybody build a proven track record. Today we review the performance of Einstein's portfolio "Platintrader 1000% Leidenschaft" and explain why his performance is a matter of trading mastership, not of just luck.

Continue reading "Einstein – a star trader on Wikifolio, who can beat the market"

Wikifolio – a genuinely social trading and investment FinTech project

Update 30.07.2017: Unfortunately, Wikifolio turned out to be not a genuinely social FinTech but rather yet another attempt to make quick money at costs of retail investors. Here we explain why (in German). But we keep the original post below for historical purposes.

Summary of advantages:

- Wikifolio allows everyone to build a proven track record. If a portfolio meets some simple requirements, an ETF on it can be issued. Technically such ETFs are issued like certificates by Lang & Schwarz and are traded by L&S directly and on the Stuttgart Exchange.

- Wikifolio adheres to maximum disclosure policy: in particular, for every portfolio they provide complete trading history in real time.

- Wikifolio is very suitable for the strategies that imply frequent trading since there is no costs per trade (only bid-ask spread and all-in fee of 0.95% p.a.)

- Wikifolio liberates portfolio management from regulatory cram and lets investors meet the portfolio managers directly (without expensive and dubious middlemen). At the same time the investors do not need to transfer their money directly to portfolio managers, so there is virtually no scam risk.

- Last but not least, numerous successful traders on Wikifolio clearly disprove the mantra that "nobody can beat the market".

Continue reading "Wikifolio – a genuinely social trading and investment FinTech project"

Calling an R-script from PHP: pitfall with loading R-packages

We continue developing letYourMoneyGrow.com and soon will make the first tool from the promised portfolio optimization toolset publicly available. And so far a small technical report. We implement the core business logic in R and wrap-up it with PHP. Calling Rscript from PHP via exec("Rscript ...") seems to be easy ... as far as you don't use any libraries. And if you do, you will get an error message like Error in library(RMySQL) : there is no package called 'RMySQL'. Fortunately, there is a solution. However, note that a loaded package may depend on other packages. For instance, RMySQL depends on DBI. Thus you should explicitly resolve this dependency in your R-code like this:

library(DBI, lib.loc = c("/home/<yourUsername>/R/x86_64-pc-linux-gnu-library/<yourRVersion>", "/usr/local/lib/R/site-library", "/usr/lib/R/library"))

library(RMySQL, lib.loc = c("/home/<yourUsername>/R/x86_64-pc-linux-gnu-library/<yourRVersion>", "/usr/local/lib/R/site-library", "/usr/lib/R/library"))

Osram (DE000LED4000) jumps 11% – acquisition offer from China – I sold the stock

According to the news a Chinese company San'an Optoelectronics has offered about €70 per share and the acquisition is "in all likelyhood". Osram provides no comments.

Continue reading "Osram (DE000LED4000) jumps 11% – acquisition offer from China – I sold the stock"

Gold down -3%, silver -5% – an opportunity to buy?

Well, if you have no position, then likely yes (as usual, start gradually, with 1% or 2% of your trading capital). I bought today, unfortunately a little bit prematurely. If tomorrow the prices recoil, I will halve my position. But I don't regret the purchase, anyway, it is a good diversification for my stock portfolio.

Five lessons to learn from The Big Short (film).

Usually I warn against making conclusions from fiction books or films about financial markets. However, the Big Short gives some genuine lectures, at least between the lines.

Continue reading "Five lessons to learn from The Big Short (film)."

Oil WTI short: why it will likely fall (29.09.2016)

OPEC agrees on oil cut at Algiers meeting ... oil price jumped more than 6% ... a good opportunity to short WTI!

- OPEC members may agree on whatever they want but it is unclear how they will control the agreement and penalize violators.

- As soon as price grows the production of shale oil in USA will be increased.

- The current Brent price is $49.13 and WTI costs $47.69. Respectively, the spread is $1.44, which is pretty narrow (normally it is about $2) so it will likely widen, thus it is better to short WTI, not Brent.

Yes, there we times as the spread was tighter and even negative, but by those times both WTI and Brent tended to fall.

Update 04.10.2016

So far the oil price keeps growing though I was right with shorting WTI, not Brent, since the latter grew more intensively; the spread is now normal, about $2.

Today it was a price dip, so I halved my position with a minimal loss and keep about 1.5% of my trading capital in WTI short.