DeGiro hat unschlagbar niedrige Gebühren, insb. wenn man mit kleinen Beiträgen handelt. Darüber hinaus gibt es über 200 ETFs, welche man ganz ohne Kosten (allerdings nicht unbegrenzt häufig) handeln kann. Dazu kann man unkompliziert short gehen und mit den Optionen direkt auf EUREX handeln. Last but not least geht die Ameldung sehr schnell und ohne Post- bzw. PhotoIdent und die Konto-Statistik wird in echter Zeit erstellt.

Die Nachteile von DeGiro sind aktuell wie folgt: zusätzliche steuerliche Belastung der Dividende durch die Quellensteuer, kein Zugriff auf außerbörslichen Direkthandel und Börse Stuttgart, sowie limitierte Einlagensicherung.

Continue reading "DeGiro – [aktuell] der Beste Broker"

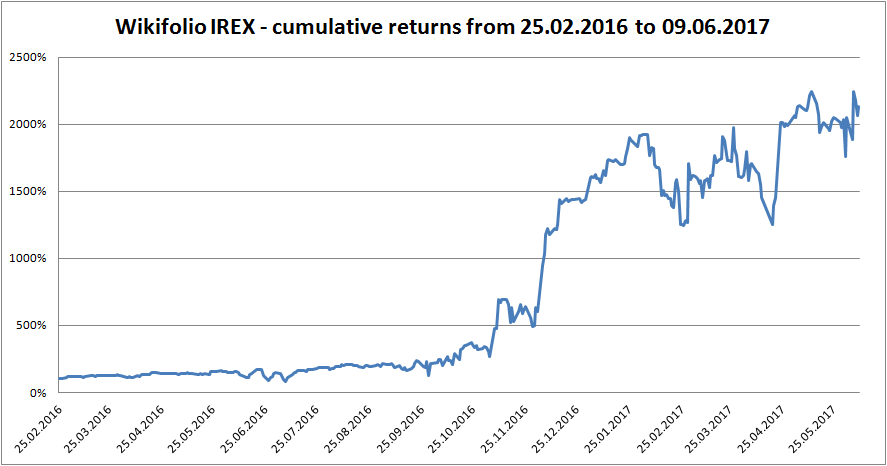

Wikifolio IREX – Wellenritt auf Tsunami – Know your risk!

Wikifolio IREX (DE000LS9JBB2) schießt hoch mit Jahresperformance von 1327% und schlägt sogar den legendären Einstein. Trotzdem raten wir IREX als Investition stark ab. Allein der Maximale Verlust (bisher) von -69.50% ist alarmierend, 25% Performancegebühr ist auch alles anders als Investorfreundlich. Darüber hinaus zeigen wir, wie unvorsichtig IRTrader die Risiken ab und zu eingeht.

Anderseits, eignet sich IREX sehr gut fürs Zocken. In positiver Sinne dieses Wortes, d.h. wenn Sie Ihr Spielgeld darauf setzen, sehen Ihre Chancen gut aus.  Continue reading "Wikifolio IREX – Wellenritt auf Tsunami – Know your risk!"

Continue reading "Wikifolio IREX – Wellenritt auf Tsunami – Know your risk!"

Gas Storage Fair Price | online Calculator

Remarkably, many market players in energy market still cannot calculate the fair value of a gas storage. In particular, many of them rely on perfect foresight. We put online a simple but correct model from QuantLib. Confidence intervals are estimated as well.

NB! This time not for retail investors but for the colleagues from energy industry. Have a look at short introductory video.

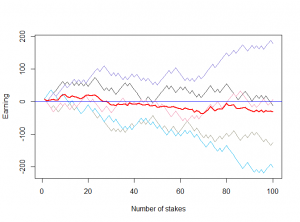

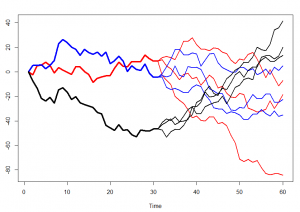

Gas Storage is a relatively complex option to evaluate, esp. if there are non-trivial constraints. Remarkably, many energy companies cannot correctly evaluate even the simplest storage contracts. Moreover, they often resort to a so-called perfect foresight: the price paths are considered random but once the price path is known, it is assumed to be known completely (like at the left-hand sketch).

|

|

| Prefect foresight (unrealistic) | One-step foresight (realistic) |

Continue reading "Gas Storage Fair Price | online Calculator"

YaWhore Dance with Yahoo Finance

On 17.04.2017 Yahoo.Finance changed its API, so ichart.finance.yahoo.com is (temporarily?!) unavailable. In particular it means that many R-scripts that rely on quantmod/getSymbols() will not function anymore. We discuss the ways to circumvent the API change of Yahoo.Finance and alternatives to it, esp. Alpha Vantage.

Continue reading "YaWhore Dance with Yahoo Finance"

Continue reading "YaWhore Dance with Yahoo Finance"

Fallen der Optionsscheine: Verlustrisiken verstehen und mit Optionsscheinrechner einschätzen

Eine Umfrage in der Facebook Gruppe "Trading and Education" hat gezeigt, dass man gegen Optionsscheine eine starke Abneigung hat. Hauptgrund war: "die Kurserstellung sei völlig untransparent". Obwohl man von den Optionsscheinen eher Finger weg halten sollte, ab und zu kann sich der Handel damit lohnen. Wir erklären die Risiken der Optionsscheine (Zeitwertverlust, hoher Geld-Brief Spread, Kursmanupulation) und bieten einen Simulator zur Einschätzung der möglichen Gewinne und Verluste an.

Continue reading "Fallen der Optionsscheine: Verlustrisiken verstehen und mit Optionsscheinrechner einschätzen"

Integrating QuantLib with R and Web – Barrier Options Pricer

Some of QuantLib functionality is ported to R in RQuantLib. In particular the pricing of Barrier options. Unfortunately, only European. But we need American in order to price and simulate future scenarios for the so-called KO-Zertifikate (Knock-Out Warrants), which are quite popular among German retail traders. We show how to quickly adopt the code from QuantLib testsuite, compile it under Linux and integrate with R and web.

Continue reading "Integrating QuantLib with R and Web – Barrier Options Pricer"

DKF 2017 – Kongress für Finanzinformationen – Kurzbericht

DFK 2017 - Kongress für Finanzinformationen - was sehr gut organisiert und die Vorträge waren sehr interessant. Zwar ist DFK 2017 eine B2B Veranstaltung, sind die angesprochenen Themen auch für Privatinvestoren ziemlich relevant. Wir danken Dr. Alexis Eisenhofer und das Team von financial.com für diese Tagung.

Continue reading "DKF 2017 – Kongress für Finanzinformationen – Kurzbericht"

Continue reading "DKF 2017 – Kongress für Finanzinformationen – Kurzbericht"

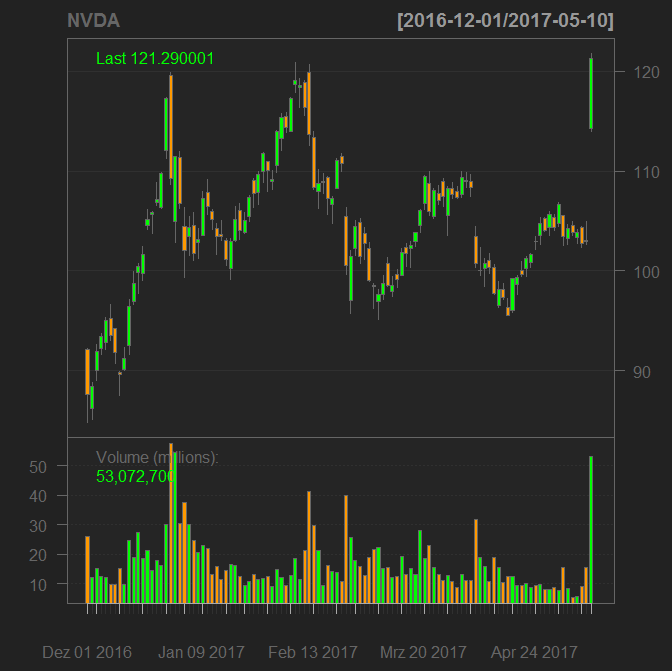

PUT on nVIDIA turned out to be far from perfect trade, but…

On 25.12.2016 I bought a put on nVIDIA since I found the stock extremely overpriced. I called it "nearly perfect trading decision", inter alia, because the implied volatility was though plausible but still high. Yesterday after the publication of Q1 financial report the stock jumped 18%. My put option is about 50% down since purchase time. But due to a strict money management I have capital for the 2nd and even fors 3rd attempt and I still consider nVIDIA as heavily overpriced.

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Continue reading "PUT on nVIDIA turned out to be far from perfect trade, but…"

Einstein von Wikifolio hat ca. €2.500.000 Trading-Kapital

Einstein, der Trader Nr. 1 bei Wikifolio, wessen Performance wir früher ausführlich gereviewt haben, teilt sehr sparsam die Information über sich selbst. Jedoch unter dem Emotionsdruck verplappert sich sogar der Einstein. Dadurch haben wir festgestellt, dass er ca. €2,5 Mio Handelskapital hat und sein Wikifolio wahrscheinlich ziemlich nah zu seinem privaten Depot liegt. Continue reading "Einstein von Wikifolio hat ca. €2.500.000 Trading-Kapital"

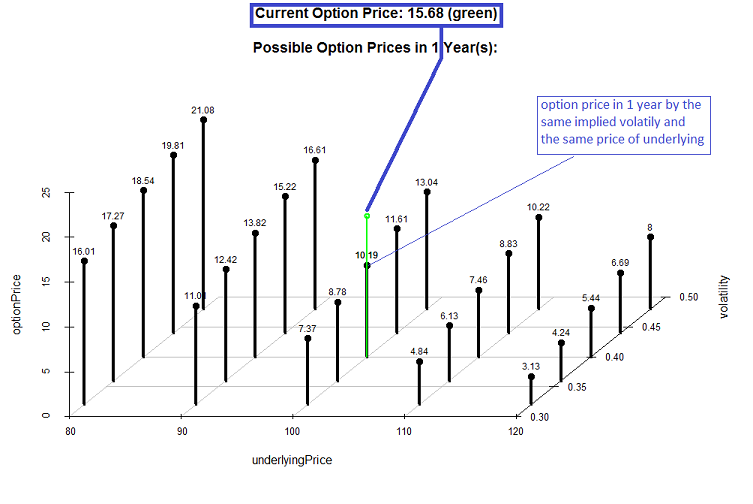

Online Option Calculator – estimate the future value of an option

Many retail investors are unaware that the option price sometimes depends on the (implied) volatility much stronger than on the price of underlying. They also often underestimate the losses of time value. Our option calculator lets you estimate the future fair price of an option by different pairs of implied volatility and underlying price.

Continue reading "Online Option Calculator – estimate the future value of an option"

Continue reading "Online Option Calculator – estimate the future value of an option"