In this essay I try to figure out the most fair reward system for a wealth manager. I don't appeal to the notorious utility functions or mathematical optimization models that fail in practice due to the errors of parameter estimation. Rather I rely on best practices and common sense. Continue reading "The Fairest Reward System for a Wealth Manager"

Tag: performance analysis

12 Consistentently Profitable Automatic FX Strategies

We consider 12 most popular and/or mostly discussed fully automated forex trading stratagies on myfxbook.com. This case study clearly shows that it is possible to consistently make money by forex trading. Of course it does not mean that it is easy. Continue reading "12 Consistentently Profitable Automatic FX Strategies"

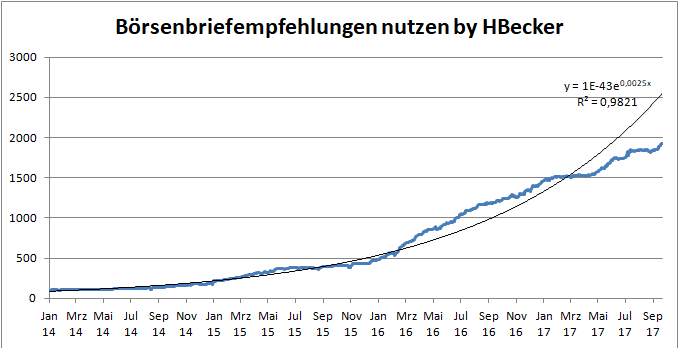

HBecker – another star Trader on Wikifolio

Earlier we analyzed the performance of Einstein, a star trader on Wikifolio who has beaten (and continues to beat) the market. There is one more luminary on Wikifolio - and it is HBecker. Formally, Einstein is Number One in terms of absolute returns (by comparable historical drawdown). However, HBecker has even smoother equity curve and much better hit rate. If you still ask, who is better, the right answer is both are better! We summarize the trading history of HBecker and remind you that Wikifolio is an excellent place to learn from experienced traders but a bad place to invest your money unless you can deeply analyze the risks.

Continue reading "HBecker – another star Trader on Wikifolio"

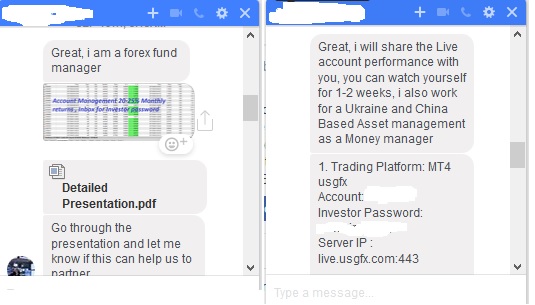

If you got an offer from a Forex Fund Manager

If you got an offer (via a social media) to provide money for an FX managed account and share the profit then you most likely encounter a scammer. However, not always. Recently, we got two offers and by these examples we explain how to distinguish a typical scammer from a trader, who likely does make money. Continue reading "If you got an offer from a Forex Fund Manager"

Continue reading "If you got an offer from a Forex Fund Manager"

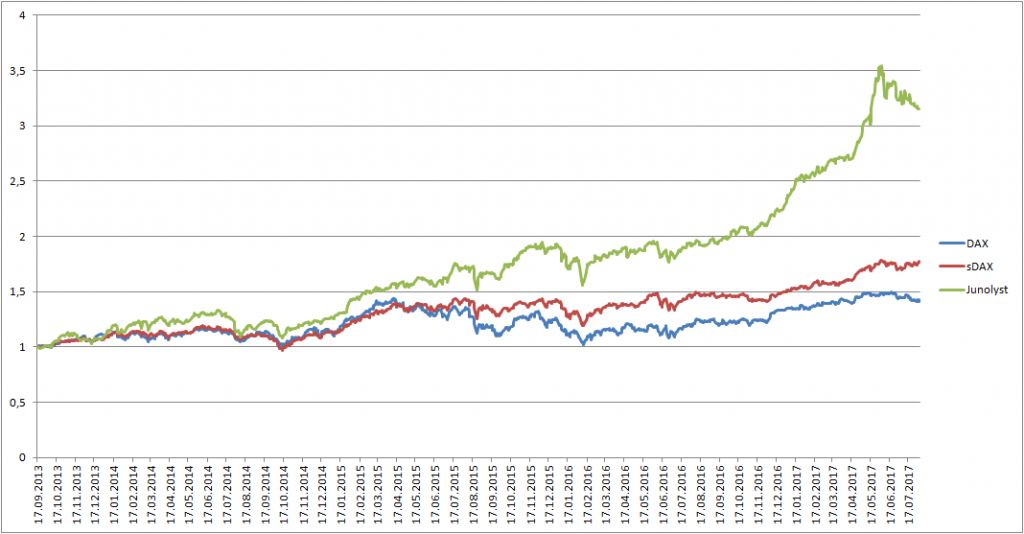

Lukas Spang (Junolyst) – neuer Warren Buffett oder nur Glückspilz?

Wir analysieren die Performance eines der populärsten Wikifolios "Chancen suchen und finden" von Junolyst (Lukas Spang, 25 Jahre alt).

Ein gewisses Stockpicking-Talent ist beim Herrn Spang vermutbar, jedoch ist die Performance seines Wikifolios im Wesentlichen durch den allgemeinen starken Bullentrend bestimmt. Hingegen ist seine Trading-Fähigkeit sehr mäßig, seine 2420 Tranksaktionen sind meistens Noise.

Wikifolio "Chancen suchen und finden" (aktuell ca. €9 Mio AUM) stoßt schon jetzt auf die Grenze der Skalierbarkeit. Viele Aktien in Portfolio sind schon überbewertet und bei allen davon ist die Streubesitz-Quote ziemlich niedrig. Das bedeutet: bei fallendem Markt wird dieses Wikifolio (mindestens) ebenso stark fallen, wie es jetzt (bei steigendem Markt) wächst!

Continue reading "Lukas Spang (Junolyst) – neuer Warren Buffett oder nur Glückspilz?"

Continue reading "Lukas Spang (Junolyst) – neuer Warren Buffett oder nur Glückspilz?"

Contango and Cash: the rollover costs are not always prohibitive

As we published our recommendation to invest in commodities, we got a remark that we should not neglect the contango effect and rollover costs. So we analyzed them and came to a conclusion that although the costs of futures rolling (and ETF fees) are not negligible, they are also not so important, compared to the recent movements of commodity prices.

There were ten futures for the nearest months

Roll over, roll over.

And the January futures was to expire

Nine!

Continue reading "Contango and Cash: the rollover costs are not always prohibitive"

Seeking Alpha and finding nonsense – never trust CAPM and linear regression blindly

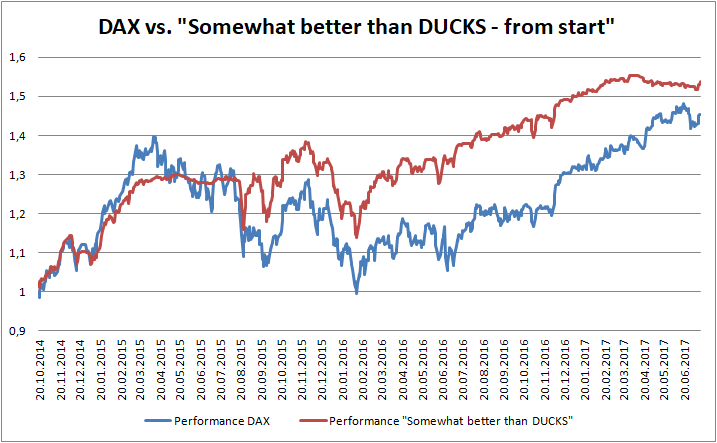

I show by the example of my portfolio "somewhat better than DUCKS" that CAPM alpha is a very non-robust measure of performance as well as that linear regression on an index should be considered very critically.

Recently, one of my facebook contacts has meant that my portfolio "Somewhat better than DUCKS" repeats the DAX with a beta but without alpha. He even did not make an effort to calculate the linear regression before making this statement. However, even if he did, the results would not be comprehensive.

Continue reading "Seeking Alpha and finding nonsense – never trust CAPM and linear regression blindly"

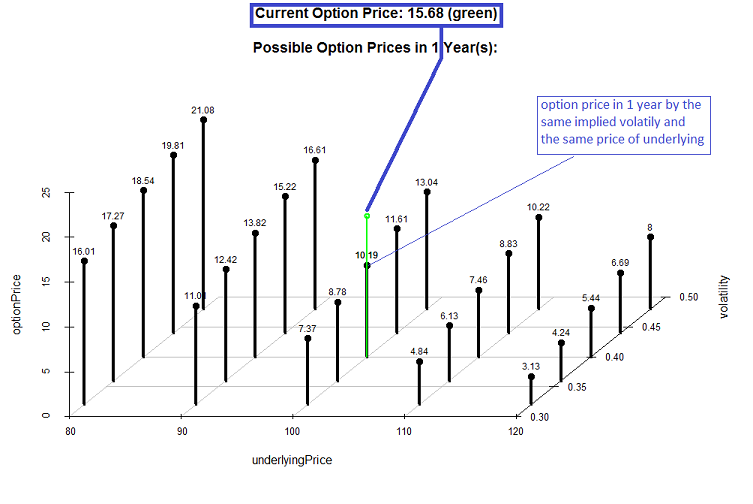

Online Option Calculator – estimate the future value of an option

Many retail investors are unaware that the option price sometimes depends on the (implied) volatility much stronger than on the price of underlying. They also often underestimate the losses of time value. Our option calculator lets you estimate the future fair price of an option by different pairs of implied volatility and underlying price.

Continue reading "Online Option Calculator – estimate the future value of an option"

Continue reading "Online Option Calculator – estimate the future value of an option"

Schlechten Tänzer stören immer die eigenen Ho(r)den

Zum 1. April veröffentlicht letYourMoneyGrow.com eine Antwort auf das Interview "Tanzen lernen Sie auch nicht ohne Tanzlehrer" von Marcus Vitt, Vorstandssprechers des Bankhauses Donner & Reuschel. Mit lustigem Titel aber ziemlich ernstem Inhalt.

Continue reading "Schlechten Tänzer stören immer die eigenen Ho(r)den"

My Fund Somewhat better than DUCKS is 1 year old: a festive but fair review

My wikifolio ("Somewhat better than DUCKS", ISIN: DE000LS9HDK3) is investable from 28.10.2016. It surely beats the DAX (main German stock index) both on absolute and risk-adjusted performance. Though I am very proud of my performance, I provide a closer look at it and show that sometimes I had just luck and sometimes I could have done better. I always preach for the rigorous and cold-blooded performance analysis and the best sermon is to demonstrate it by the example of myself.

Continue reading "My Fund Somewhat better than DUCKS is 1 year old: a festive but fair review"