One year ago we launched letYourMoneyGrow.com and we already can report some achievements!

1. We have created and keep developing our Quantitative Toolbox. In particular, you will not find suchlike Option Calculator with scenario simulation or mortgage calculator with estimation of the interest rate risk anywhere else.

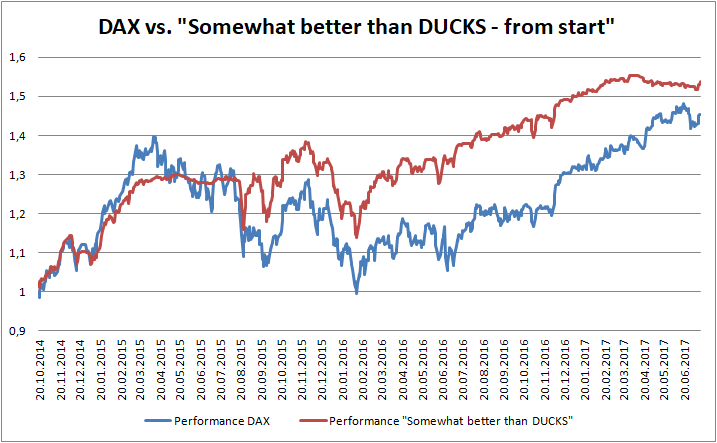

2. Thanks to Einstein, we disproved the stupid mantra that allegedly "nobody can be better than the market". On the other hand we have shown that many "solid" institutional asset managers and [self-proclaimed] stock market "gurus" cannot beat the market. Thus, only track record matters!

3. We have demonstrated, first of all by the example of IREX, how a quantitative performance analysis can help by investment decisions. At least in case of IREX it was clear that the guy will fail and he recently did!

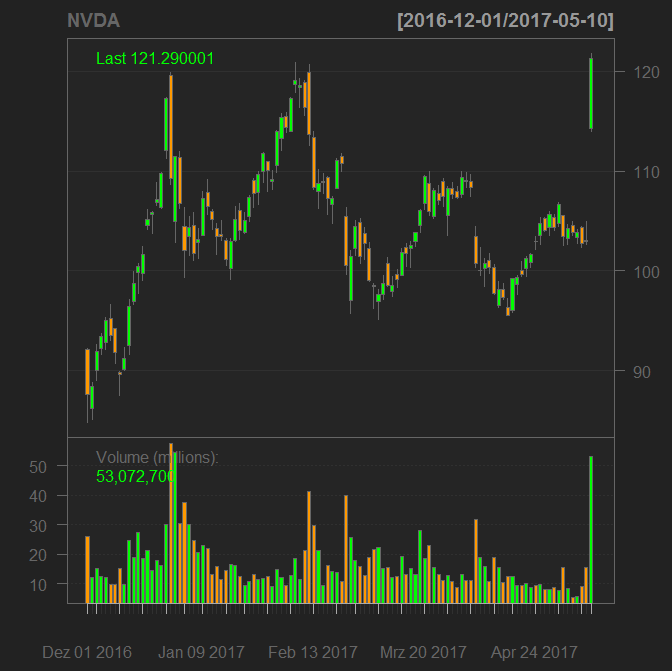

Our next big goal is to automatize the asset screening as much as possible. Continue reading "letYourMoneyGrow.com is one year (and one day) old!"